SaaS: The sunrise sector creating global companies from India

Once upon a time Software was eating the world, now Software-as-a-Service (SaaS) is eating Software! Are you at the table?

The good news is that a whole host of India-based SaaS startups are creating products that are being adopted by a global customer base, resulting in high-value companies with strong revenue streams. The even better news is that these companies start generating revenues almost from day one. This translates to SaaS companies needing a much shorter time period to become highly scaled global majors. Just look at Freshworks, the Chennai and San Francisco based SaaS company that went public on Nasdaq at a valuation of $13 billion in September this year—just 11 years after its founding.

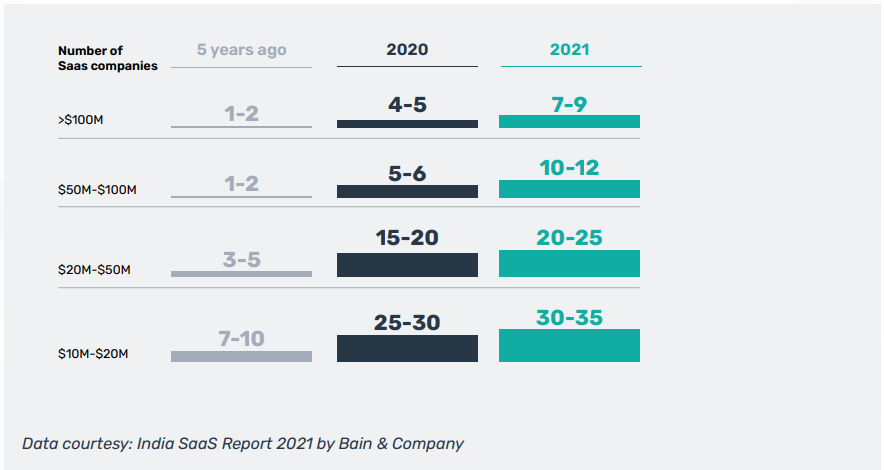

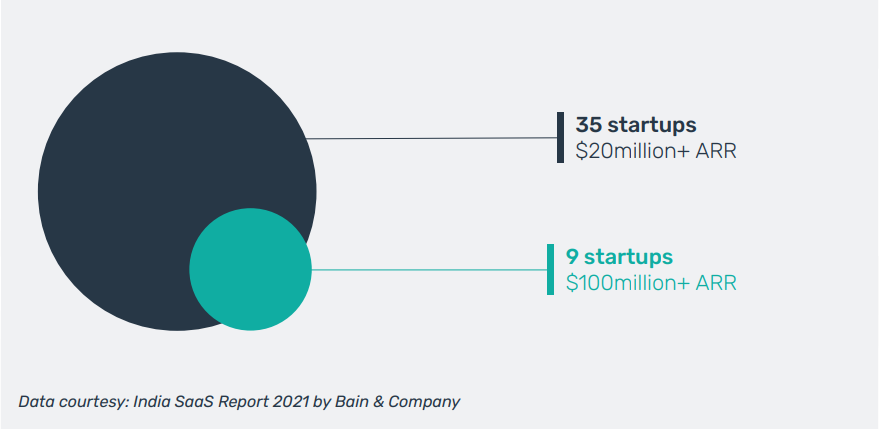

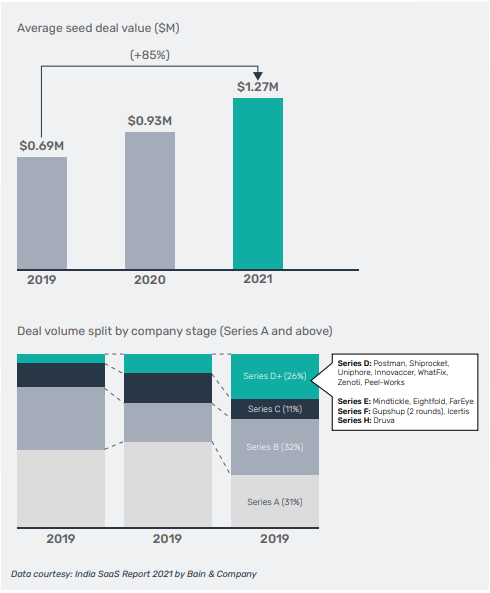

India is home to about 1,000 SaaS startups, a noteworthy statistic considering this industry came into existence in the country only a little over a decade ago. Collectively, these startups boast of an annual revenue of $3 billion right now. According to a recent Bain & Company report, over 35 SaaS startups in India have an Annual Recurring Revenue (ARR) of over $20 million, with around seven companies bringing in ARR of over $100 million in 2021.

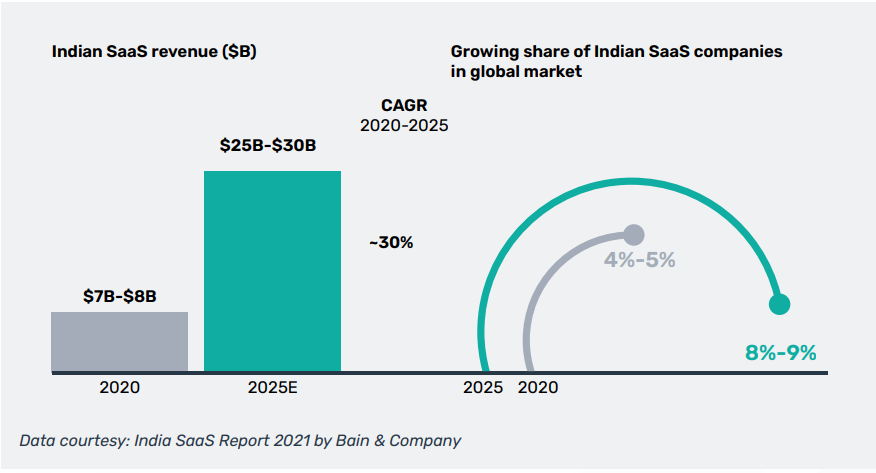

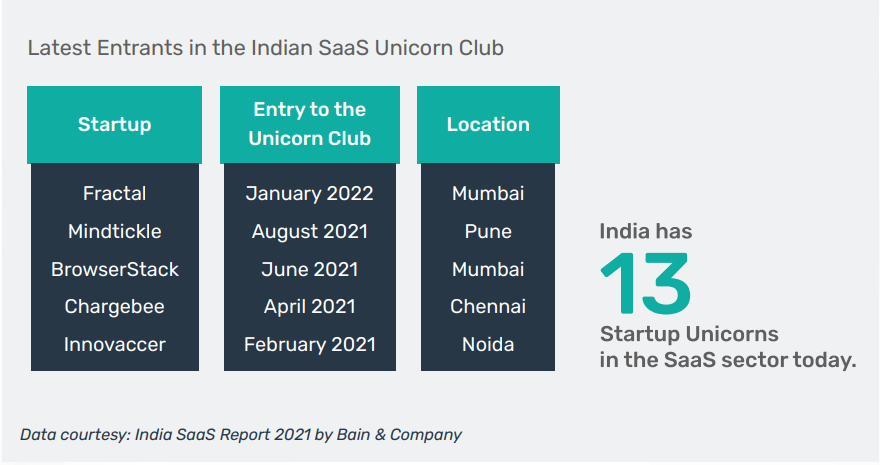

Indian SaaS companies are expected to grow their revenue to $30 billion by 2025, capturing 8% to 9% of the global market. Not surprisingly, investors are increasingly backing SaaS startups. The Bain & Company report estimates that SaaS startups will raise $4.5 billion in funding this year, compared to $1.7 billion last year, a whopping 170% jump! This isn’t surprising, as the young industry already boasts of 13 unicorns in India.

Interestingly, in our recently published survey report, The Private Market Monitor, on how family offices and UHNIs are investing in startups, SaaS was actually one of the sectors with the highest investor interest alongside fintech and above consumer tech.

But considering how young the SaaS industry is, not many understand how truly different SaaS is from India’s legacy IT and ITeS sector. India’s massive ITeS industry, which continues to thrive, builds products and offers technology-enabled services for clients that include some of the top enterprises in the world. While SaaS does include the term ‘Service’ in its name, the business and revenue model is entirely different from that of ITeS. At its simplest, SaaS companies build a software product, which could be a productivity tool or a website testing tool or even a whole host of business process software modules like Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM). The software is completely cloud deployed, which means there is no requirement for on-premise installation. Customers access the software using a simple login, like how you access your preferred email service, and pay a subscription fee, which typically is linked to the level of usage. Some SaaS products cost the clients as little as a few dollars per month.

In SaaS, the proprietary software product is offered as a service. The advantage that SaaS companies have over not just traditional software but also other types of startups lies in this very business and revenue model.

Since the cost of a SaaS subscription is very low, with most subscriptions priced at around a few hundreds of dollars, it is highly affordable for clients and many are willing to try out even a hitherto unknown product.

With open source tools and APIs (APIs or Application Programming Interface is code that allows transmission of data between two software applications and also allows new software products to be easily built atop existing software) available, it is faster, easier and cheaper to build a SaaS product today. The time to market is a few short months.

![]() “Once a SaaS product hits the market, in a very short span the team can figure out if it will succeed or not, as clients start paying from almost day one, typically after a short trial period. Since this is a subscription-based model, the life cycle value of a client is very high.”

“Once a SaaS product hits the market, in a very short span the team can figure out if it will succeed or not, as clients start paying from almost day one, typically after a short trial period. Since this is a subscription-based model, the life cycle value of a client is very high.”![]()

There are regular, recurring payments coming in from every customer added. Which is why Annual Recurring Runrate (ARR), which is the projected annual revenue for the next twelve months if no new client is added or no existing client leaves, is such an important metric for SaaS companies. Every new client added translates to growth.

A key advantage SaaS has is the global market. For many Indian SaaS companies the market is in the USA and Europe and the rest of the developed world. While in the initial days of Indian SaaS, global clients were wary of trying an ‘Indian’ product, that is not the case today. One, like I said, these products do not cost much for a US-based client, even if they are a small business. Two, the past successes of Indian SaaS companies have helped build confidence that these are not fly-by-night operators. Subscription and billing management company Chargebee, software testing platform BrowserStack, API development platform Postman, cloud software provider for salons Zenoti, marketing automation platform WebEngage, virtual events platform Airmeet, and HR software platform Darwinbox are just a few of the SaaS success stories to have emerged.

![]() “The pandemic has also triggered a significant change in behaviour. With companies going remote, most are looking for digital tools that enable businesses to run operations smoothly online.”

“The pandemic has also triggered a significant change in behaviour. With companies going remote, most are looking for digital tools that enable businesses to run operations smoothly online.”![]()

In SaaS, we are seeing truly global companies being built out of India.

While SaaS may be quite different from ITeS, a key similarity is the cost advantage that the two industries share by running their operations primarily out of India. While many SaaS companies are registered in the USA, and I will expand upon that later, the significant portion of their engineering, marketing and even sales teams are in India, at least for the first many years. SaaS already employs over 60,000 in India, as per the Bain & Company report. The cost of engineering talent is still comparatively cheap in India. Plus, most marketing and sales, especially in the initial years, are entirely online driven. So these teams are also based in India. Which also translates to lower costs.

![]() “A key advantage that Indian SaaS companies have over global peers is the high quality service they offer to clients, the kind that many companies in the developed world are not used to.”

“A key advantage that Indian SaaS companies have over global peers is the high quality service they offer to clients, the kind that many companies in the developed world are not used to.”![]()

SaaS companies in the USA or Europe work on a minimum after-sales service and low hand holding model, as they cannot afford to have large customer service teams. That’s not the case here. Getting immediate responses and being able to speak to a customer service person to sort issues translates to customer delight.

For such a young industry, investors have been quick to back companies. Investments have gallopped since 2019 and with the high-voltage Freshworks IPO the sector will see a definite increase in funding. Freshworks’ seed investor Accel saw the value of its about 26% stake in the company jump to $3 billion with the listing. The company had raised about $480 million overall before its IPO.

Indian SaaS space has also offered profitable exits to investors through M&As. In October, Microsoft acquired Ally.io, a Chennai and US-based goal management and business execution SaaS startup, backed by investors like Greenoaks, Tiger Global, Accel and Vulcan.

Ally was founded in 2017. In September, US-based notetaking and project management SaaS company Notion acquired Hyderabad-based Automate.io, which offers a SaaS-based platform that helps companies automate their workflows. In March logistics unicorn Delhivery acquired Primaseller, a SaaS business focused on omnichannel retailers.

While India’s top VC investors, Accel and Sequoia, have a strong SaaS focus, in recent months SaaS-focused funds have also been set up. Together, Avataar Venture Partners and Unicorn India Ventures are a few such funds.

This does not mean there are no challenges. Most Indian SaaS companies are domiciled abroad due to operational and other ancillary reasons. The recurring payments issue is just one of the many challenges that India-based SaaS companies face. Competing in the global market is not easy. Selling to the US with an Indian team has its own challenges—understanding the nuances of the USA and European market takes time. Many SaaS companies do hire Sales and Marketing teams and even Influencers in the USA to bridge this gap and these employees do not come cheap. Further, Indian talent is also getting expensive. So the cost advantage is getting narrower.

Like we saw earlier, SaaS companies have renewal rates which can drive long term

success. SaaS startups are also unique in terms of high recurring revenue and gross margins. Hence they demand to be valued based on different attributes than startups in non-SaaS sectors. For instance, product-market fit can be proven faster in this sector, so the age of the startup is not relevant in valuation. Also, Monthly Recurring Revenue (MRR) is more important in predicting future revenue growth for an early stage SaaS startup than ARR.

For SaaS companies, churn rate is an integral part in determining valuation. It shows how long a customer uses the company’s software before discontinuing. (The percentage of customers who discontinued their subscription versus those who didn’t is usually calculated annually. It can predict your monthly revenue and when you can slow down customer acquisition.)

![]() “If churn rate is kept minimal, it increases the lifetime value – which means you can afford higher customer acquisition cost during growth mode, or raise your profit and, in turn, the valuation.”

“If churn rate is kept minimal, it increases the lifetime value – which means you can afford higher customer acquisition cost during growth mode, or raise your profit and, in turn, the valuation.”![]()

An additional advantage would be getting the startup’s technology patented, as it

establishes their USP and proves an edge over their competitors.

Depending on profitability, SaaS companies are valued on the basis of their revenue, EBITDA, or SDE (Seller Discretionary Earnings). If a SaaS startup’s annual growth rate is at least 50% and ARR above $2 million, a revenue-based valuation – say 3x to 15x of annual revenue – makes sense. The SDE valuation method is usually meant for those with less than $5 million ARR.

The opportunity to invest in a sunrise sector does not come too often. SaaS presents that opportunity, right now.