Serious business in secondary market

The startup ecosystem is grappling with weak funding momentum and valuation clashes.

But that is just the primary market of startup funding and investment.

The secondary market, where investors trade existing shares in startups or funds, is lit.

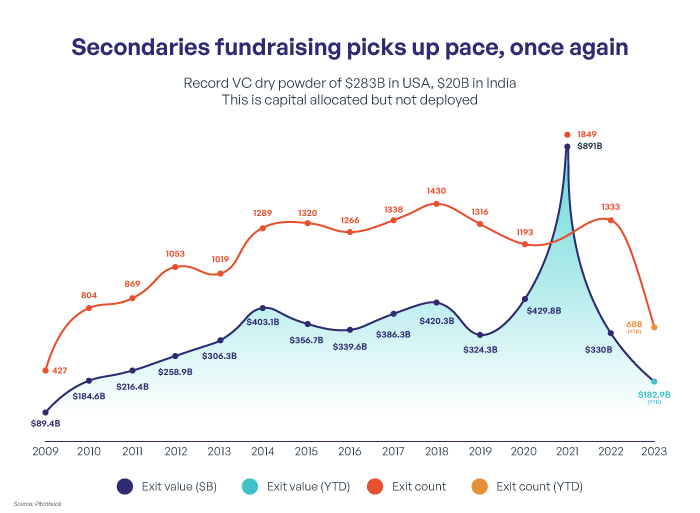

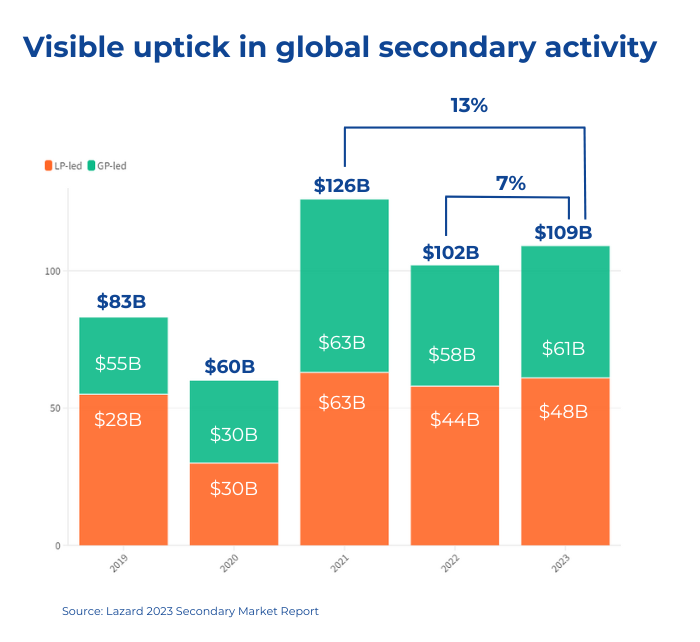

Experts forecast 2024 as a record year, with secondary transactions touching $150 B. Last year, global secondary transactions reached $112B, the second highest figure after $132 B in 2021, according to Jefferies report on the global secondary market.

Investors are bullish and anticipate the market to remain strong with a steady flow of opportunities over the next two years. In January 2024, Lexington Partners raised $22.7 B, making it the highest-ever secondaries fund.

Why Now

Secondaries is not a new market; it has always remained a promising exit option for investors to offload their shares in private markets that are largely illiquid.

Secondaries is not a new market; it has always remained a promising exit option for investors to offload their shares in private markets that are largely illiquid.

It is worth noting that activity in the secondary market has not only remained steady throughout the last eight years but has surged in periods of extremes as well: the highs of 2021 as well as the current slowdown. Now experts expect deal volume this year to meet or even exceed 2021 levels.

What makes the secondary market important for private market stakeholders today?

Multiple factors converge:

- Limited exit options through traditional routes such as M&A and IPO

- Persisting demand for liquidity

- Sizable dry powder among secondary investors and funds

- A dwindling bid-ask spread

Demand for liquidity is especially loud and clear. In fact, it has become the main reason for LPs to sell in the secondary market, driving 44% of LP-led transactions in 2023, according to financial advisory and asset management firm Lazard.

This marks a dramatic increase from only 10 percent of the transaction being motivated by liquidity in 2022. LPs were then initiating deals mainly due to portfolio management (64 percent) and vehicle wind-down (17 percent). Even in deals initiated by GPs, LPs have preferred to sell when given the option to liquidate or invest in a continuation fund.

The universe of the secondary market itself is growing fast with more products and platforms coming to the fore to fill in the information gaps in a market where most of the deals and activities are more difficult to track. Dealmaking here has also become a reference point for investors in the primary market when there was significant uncertainty around determining the value of startups right after the pandemic high saw inflated valuations in startups and tech companies.

Valuation concerns and the pricing gap at which buyers and sellers were willing to trade private equity assets had hampered deal closures till about a year ago, private equity practitioners told Pitchbook. However, investors are willing to adjust valuations as they become more confident and comfortable to trade.

Looks like all stars have aligned for the secondary market to flourish and domestic and global LPs are strategizing to make the most of this golden opportunity.