Not fair to write off 2024

As startup founders and investors settle in a realistic market condition, all stakeholders in the ecosystem seem to be waiting in the wings to understand what the future holds. We spoke to Siddarth Pai, Founding Partner, 3One4 Capital, to catch the pulse of the startup ecosystem in India and what to expect in 2024.

Below are excerpts from the exclusive interview.

Will the funding winter thaw in the New Year? What are the market sentiments?

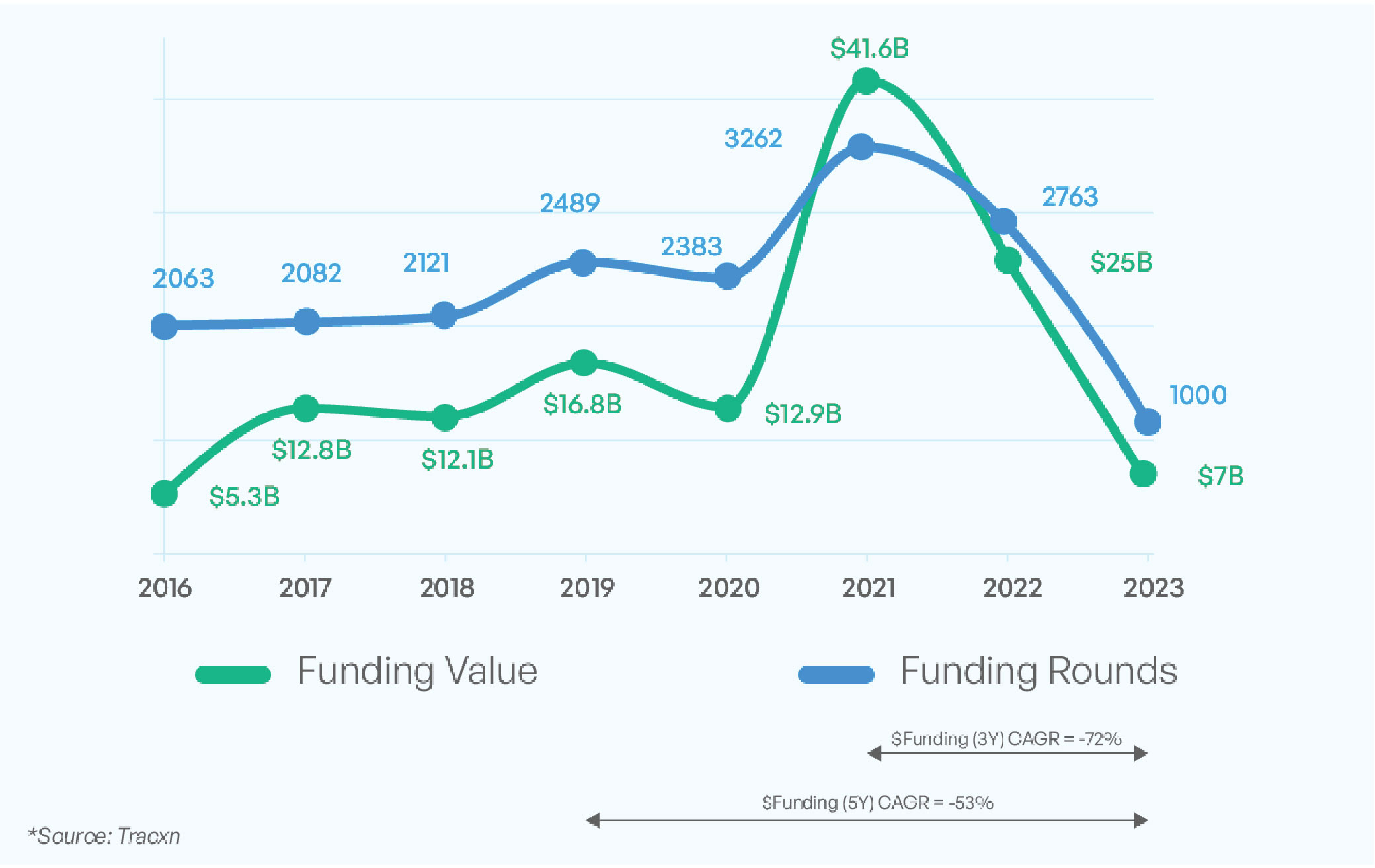

Siddarth Pai: If you look back, 2019 was one of those peak years when things were going well. In 2020, the market crashed in the first half of the year because of Covid. In the second half of the year, the market pumped up. In 2021, the market was soaring and breaking all records. But by 2022, everything came crashing down.

The bottom happened earlier this year. We’re past the bottom as of now. I believe the 2023 numbers are slightly better than the 2022 numbers. One thing to understand is that the number of deals announced in early 2022 was cracked in 2021. Normally, there’s a one-quarter difference in terms of deal announcements as well.

By May or June of 2024, right after the general election result gets announced, we’ll end up seeing a lot more funding action. After the recent state elections, there’s a lot more confidence in the continuity of government and its policies.

Even though market sentiments are high and people are looking at India far more favourably, I think this is a global issue where people say, let’s pause making really large allocations and bets as of now.

People are no longer just looking at the top-line metrics and turning the page. They are examining their entire expenses and cutting costs, figuring out how to optimize and prepare themselves for maintenance of a high-interest rate regime at least for the next three to four years. So they are no longer wondering: ‘It was so easy to raise in 2016 and 2017. Why is this tough now?’ That kind of conversation isn’t happening.

All the companies who thought they would go back to the 2021 kind of heyday have more or less died at this point. Or they’ve had to lay off staff, or they’ve cut down on business and are looking to rebuild.

In 2024, we’re going to start seeing IPOs slowly pick up. I think everyone has their sight on the Swiggy IPO right now. That will be the IPO that kickstarts the entire IPO cycle. I foresee at least six to seven new unicorns ending up hitting the market.

The year 2024 will end up being one where we start seeing the numbers exceed what we’ve seen over the last couple of years, except the Covid 2020-2021 period. 2025 is when we’ll start seeing the inflection point hitting. I don’t think it is fair to write off 2024, barring some major global dislocation or something.

The year 2024 will end up being one where we start seeing the numbers exceed what we’ve seen over the last couple of years, except the Covid 2020-2021 period. 2025 is when we’ll start seeing the inflection point hitting. I don’t think it is fair to write off 2024, barring some major global dislocation or something.

The sentiment is also that people have taken a pause right now. The dry powder is burning a hole in investors’ pockets, even though they’ve been tracking some of these companies for an extensive period. Most larger investors have a wish list of companies they are talking to.

The positivity of the IPOs will only end up adding to the desire to deploy capital. I think that’s the trend we are seeing. We’ve spoken to family offices and UHNIs, barring the ones who have exposure to pre-IPO companies who were supposed to IPO 18-20 months back but haven’t as of now. The sentiment is bullish and it is more bullish for companies that are anywhere between $100 million and $400 million stage.

Another important sentiment now is even investors and founders have realized that there’s no point going to market when you’re already one-and-a-half / two billion dollars and everything is fully baked.

Some companies are saying, ‘Look, even if I’m valued at anywhere between about $600 million to about $900 million, I will end up planning an IPO fairly quickly. Because now, one thing we’ve realized is the moment you go to the market so well baked, the multiples you end up getting in valuation become much harder to get by. Even the public market investors are very wary of companies who are coming in fully priced in. It will take two to three years for them to end up breaking out. So no one has that kind of patience.

We will start seeing a lot more activity in the primary markets as of now and the time to IPO has been crunched from nine-ten years to about six-seven years. These are billion-dollar IPOs but they’ll end up actually growing within the public market sphere and scaling up also. For example, MapmyIndia has shown that if you do execute as per plan, you can raise about $100-200 million from the public markets fairly easily. So, we’re seeing that entire kind of switch happen over here.

It is going to be better times ahead. Most of the pessimism has sort of played out as of now. They may not be as frequent, but they will end up being very strong.

They may not be as frequent, but they will end up being very strong.

The top one or two companies in every sector will find it far easier to raise money in 2024 than they have in 2023 for that matter.

What is the difference in the quality of startups getting funded today versus startups that were funded in 2022 and 2021?

Siddarth Pai: Capital is no longer the most defensible moat. Earlier, if you were number three or four, there was a good chance you could end up raising a large amount of cash. Now everyone’s just chasing the one or two winners. The others have to spend a large amount of time to convince the market that they are worthwhile investing in.

That’s why I said you won’t see the kind of deal volumes like in the past but the good companies will end up raising money hand over fist. So there’s a consolidation phase that’s going on now.

Right now, one of the first things that is coming out is that the respect for capital is at an all-time high.

In 2020-2021, investors were under immense pressure to deploy. If you speak to investors off the record, they will say, “It may have been premature to invest in the company that I did.” That regret is absent as of now. They are a lot more choosy on that matter.

Simultaneously, even founders who would come to investors saying, “Look you have 24 hours to sign (the term sheet) otherwise I’m going to go to the next person,” all that has gone. Now the conversation has moved from, “In the next two to three years, I’ll do this,” to “Here’s what I’ve done as of now.” Even the projections are far more realistic.

What we are seeing is greater realism punctuating the market. It is contributing to far more sustainable businesses. Growth is no longer the only thing they put on their pitch deck. They are talking about margin profile, expanding the margin, cost reduction, and how to become a more sustainable company.

Founders, too, no longer want to remain private or hold onto private market investors for long periods. They also realise they prefer freedom and a larger and wider capital base, and say that the public market can end up offering that to us. We’re seeing that shift across the board.

To round up the answer, the founders we are seeing now are far more mature and knowledgeable, and the level of experimentation and the time they need to achieve product-market fit to begin monetization and start developing a strong margin profile has sharply increased.

What used to be Series C metrics two years ago are now what people expect at a Series A level. It’s no longer just about saying, “I’ll raise four rounds of funding, raise about $100 million and then start revenue projections.” They start showing revenue after the Seed or pre-Series A round also. Otherwise, incoming investors or larger investors won’t be cutting a cheque.

Even the quality of decks and ideas that come in are better. Most of these ideas do not require an almost limitless amount of capital. They require just an initial round of funding and can start scaling up.

What are the hot sectors? And what do you look for in pitch decks?