Exits are more real and predictable than ever before

Founders have settled in the reality of building businesses. Sanjay Swamy, Managing Partner, Prime Venture Partners, believes all startups in the ecosystem today fit in four distinct categories and that there’s a promising path to liquidity in India.

Below are excerpts from the exclusive interview.

Will the funding winter thaw in the New Year? What are the market sentiments?

Sanjay Swamy: The worst period, in hindsight, was 2021 when there was too much money in the market.

More than a funding winter now, there was an extremely overheated funding summer in 2021. I’ve always believed good companies don’t die of starvation, but they do die of indigestion.

In 2021, we were causing a lot of indigestion for which we are paying the price now. And the recovery from that is a very long-term process.

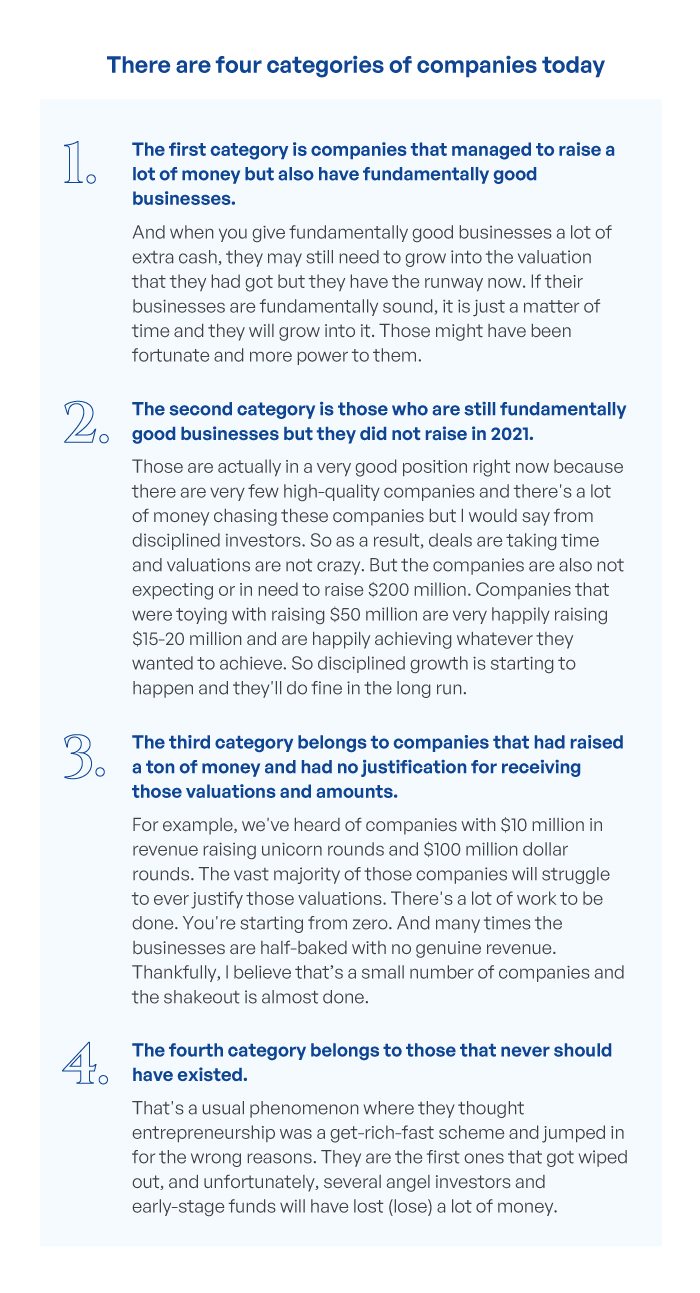

The first two categories are where the strong companies are getting built. I think that is the majority of the ecosystem. The fourth category is probably large in numbers but seen in very early companies. The third category is the one that is the worst hit.

I’m not too bothered by what we’re seeing at a macro level.

In that sense, that was a highly needed and very important mindset shift that had to happen. Medicine is bitter. Sometimes, you need to throw these things out of the system.

What is the difference in the quality of startups getting funded today versus startups that were funded in 2022 and 2021?

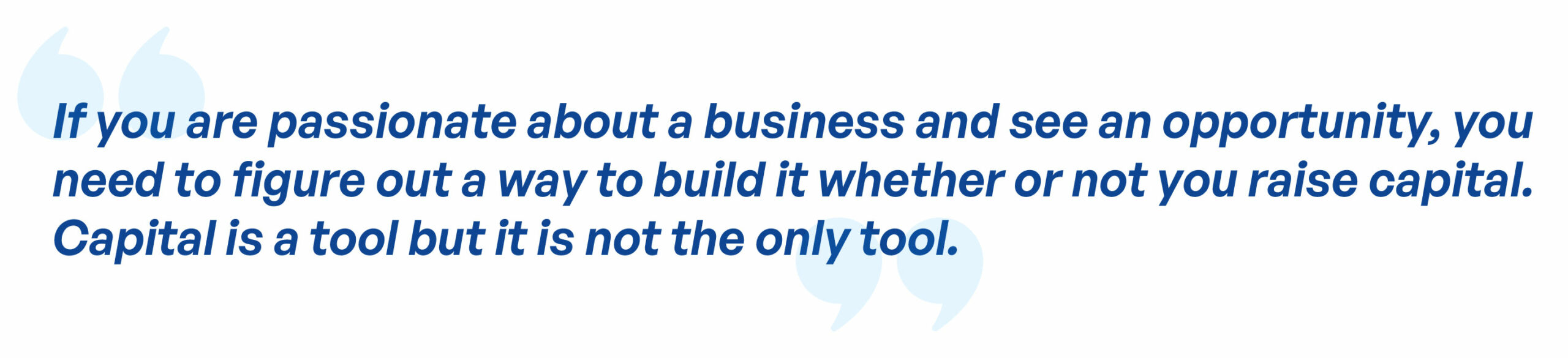

Sanjay Swamy: When founders say they want to start a company only when they raise funding, is the dumbest thing I’ve heard.

My point is that capital should not decide whether you’re going to build a company. Capital is an accelerator. I think we got to a point where the primary tool to build was capital and that has gone.

What are the hot sectors?

Sanjay Swamy: We are always bullish on businesses where there are large profit pools and where digitization can create an opportunity for a company to capitalize on these profit pools in the early days of the market.

We don’t draw a stance on whether we won’t do this or that. We have continued to fund education/edtech businesses and fintech lending businesses. If anything, we are more convinced about opportunities in those sectors, especially with the emergence of generative AI. Gaming is another one that’s coming of age. Digital health, logistics, supply chain, and financing are some others.

Read the full interview in our new report: ‘The Great Metamorphosis: Private Market Investing Outlook, Insights & Projections, 2023-24’.

Read the full interview in our new report: ‘The Great Metamorphosis: Private Market Investing Outlook, Insights & Projections, 2023-24’.