Can SPACs live up to the buzz

THE “SIX SPAC”

I sometimes think that the world of finance and capital markets is the most interesting spectator sport there ever is. Just look at the Game stop saga. What drives the financial markets? FOMO -Fear Of Missing Out. When one concept, stock, or segment starts seeing heavy investor activity, how can investors know whether that’s just FOMO rearing its head, or if the underlying fundamentals are truly strong? I was thinking about this recently because of the rise of SPACs or the Special Purpose Acquisition Company.

I sometimes think that the world of finance and capital markets is the most interesting spectator sport there ever is. Just look at the Game stop saga. What drives the financial markets? FOMO -Fear Of Missing Out. When one concept, stock, or segment starts seeing heavy investor activity, how can investors know whether that’s just FOMO rearing its head, or if the underlying fundamentals are truly strong? I was thinking about this recently because of the rise of SPACs or the Special Purpose Acquisition Company.

Th

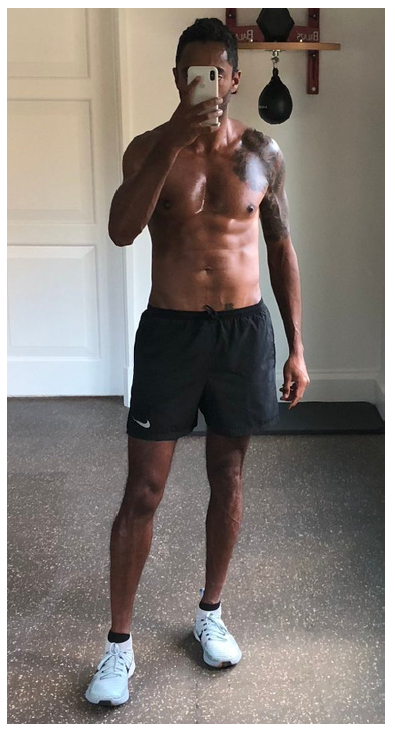

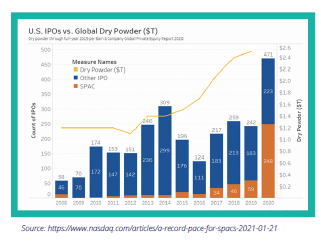

e SPAC truly became prominent in2020, with 248 SPAC IPOs in the US raising $83 billion collectively – that’s half the number of all IPOs in the US. What’s more, marquee investors like Chamath Palihapitiya (pictured alongside!) and Bill Ackman and celebrities like former basketball star Shaquille O’Neal have emerged as key sponsors of many of these SPACs, giving such companies and their fundraises greater prominence and thus increasing the buzz and chatter around them.

Billionaire Chamath Palihapitiya has sponsored

six SPACs

and notably took Virgin Galactic Holdings public by merging one of his SPACs with the space company. Former Citi i-banker Michael Klein transformed a $25,000investment into $60 million when his

SPAC Churchill Capital Corp acquired and reverse merged with data company Clarivate Analytics in 2019.

But increased interest does not equal increased knowledge, so let’s take a closer look.

WHAT IS A SPAC?

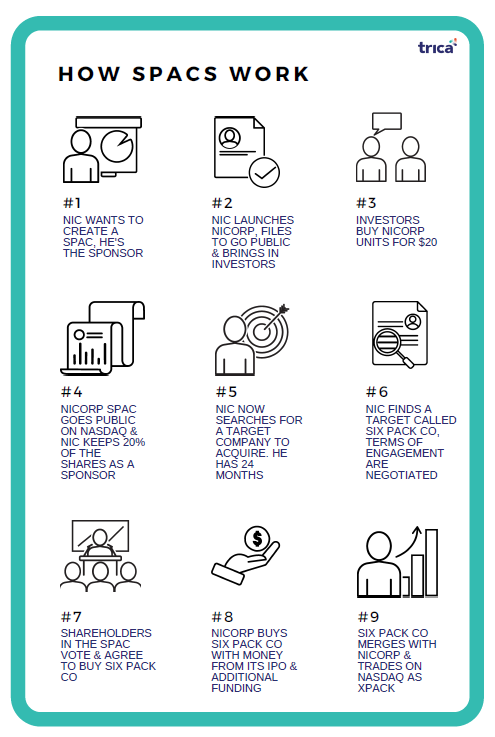

While there are many rules and regulations associated with SPACs, at its simplest a SPAC is a company that is set up by someone with an investment pedigree (known as the Sponsor) with the sole purpose of listing and acquiring another company.

Like you saw a SPAC’s only ‘business’ is to raise funds through an IPO and then hunt for the target company with which it will merge. Which is why such an entity is also referred to as a “blank cheque company”

.

During the IPO investors purchase shares and get warrants that offer them an upside and act as a sweetener. The capital raised through the IPO is placed in an interest-bearing trust account until the target company is identified.

The SPAC has about two years to discover this target and complete are verse merger. If it fails to do so, it has to return the money with interest to the investors. In such an event, the sponsor loses his investment.

If some investors do not find the target company attractive, they can redeem their shares and do not lose the initial investment.

The deal value of the acquisition could be four to five times higher than funds raised by the SPAC. The difference is met through fresh investments, mainly in the form of Private Investment in Public Equity (PIPE) deals. At the time of a public listing large private equity and hedge funds can directly invest in and acquire shares of a company at share price or at a discount without going through the stock markets. The funds get access to non-public information on the potential target company from the SPAC after signing anon-disclosure agreement and get the option to invest at the time of merger.

…BUT WHY ARE SPACS HOT NOW?

In a sentence, it is the sheer volume of dry powder sitting with investors. Global PE dry powder is at about $2.5trillion. SPACs also offer a simplified path to taking a company public and to access the public markets for both investors and private companies.

In a sentence, it is the sheer volume of dry powder sitting with investors. Global PE dry powder is at about $2.5trillion. SPACs also offer a simplified path to taking a company public and to access the public markets for both investors and private companies.

WHAT’S INIT FORINVESTORS?

For the record, we cannot list a SPAC in India due to various rules and regulations around shell companies. But investors and funds, based in India can participate in a US-based SPACIPO just like they would in a regular IPO.

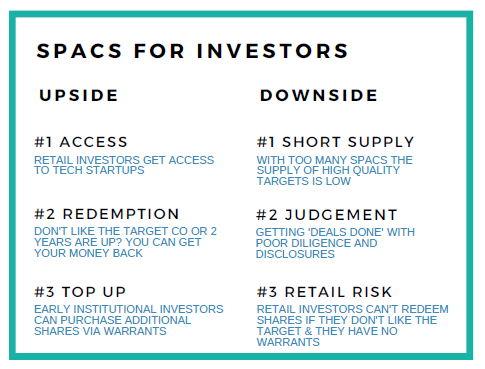

For investors, there are various reasons for sponsoring or investing in a SPAC. Let’s look at a few of them:

- In regular IPOs, the focus is on the past performance of a company and forward looking statements are penalised. That’s not the case with a SPAC IPO as there is no past performance to talk about and plans and futuristic statements are protected under safe harbour laws. This is attractive for many Sponsors.

- A marquee investor leading a SPAC acts as a confidence booster for other investors and chances of a number of investors backing such a SPAC goes up.

- For the Sponsor, the substantial Founder shares and warrants are valuable. It is not everyday that you get to own 20% of a company for $25,000.

- For regular investors, SPACs make for a safe bet because their funds are parked in a trust and invested in US Treasuries until the merger.

- Off late a majority of the SPACs have sponsored startups and companies that are pushing the boundaries of tech and are innovative. Being an investor in a SPAC gives funds and individuals the opportunity to potentially become an investor in such cutting edge companies. More on this below.

- In many cases, the investors in a SPAC sell their shares before the merger or at the time of the merger and are able to book a profit.

WHAT ABOUTINDIANSTARTUPS?

For Indian tech companies, a SPAC is a potential route to a US IPO. This is what Yatra did in 2016 when it reverse merged with Terrapin 3Acquisition Corp, in a deal that valued the online travel agency at$218 million. In 2015, Videocon d2hhad also sold 33.5% stake to US-based SPAC Silver Eagle Acquisition Corp for about $375 million. However, other companies have not followed suit.

Why is this route attractive to Indian (and other) tech startups:

- Doing a regular IPO is a time consuming and expensive affair for even highly valued companies. For super-growth startups in market segments that are still not proven, a US listing is an even more daunting task. A reverse merger with a US SPAC offers back-door entry to the US public market to such companies.

- A company’s IPO depends on past performance. In a reverse merger with a SPAC a public company is acquiring a private company, with the latter becoming the public entity in the end. The target company also benefits from safe harbour protections and can make forward looking claims and projections. It can also disclose greater and confidential information to the investors taking part in a private placement and these investments are then publicly disclosed, acting as an effective validation tool.

- Since this is technically a merger, it will take less time for the target company (the hypothetical Indian tech startup) to become a public entity compared to the traditional IPO route. While a traditional IPO can take between 12 to 18 months, a merger is done and dusted with negotiations lasting for just a few months.

- Why is this route attractive to Indian (and other) tech startups:

For late-stage companies, thisroute allows them to raise fundswith common shares rather thanpreferred shares like in a PE deal.Moreover, valuations are morerealistic and the target companyhas greater say and control as theyare part of a merger negotiation.

WHAT’S THEDOWNSIDE?

If everything was great about SPACs, this would be the most preferred IPO path. But that isn’t the case because there are risks and costs:

- For an investor intending to stay the full course, there is the risk of a merger never happening. Right now about 300 SPACs with around$90 billion are on the hunt for companies to acquire. How many of them will eventually find a truly valuable target is a question whose answer we will know only in a couple of years.

- While the Sponsor can make huge returns on their investment, individual investors who come in late in the game see limited upside.

As Goldman Sachs Group Inc. Chief Executive Officer David Solomon warned if the ‘bubble’ bursts the handful of insiders will walk away with their money.

- The SPAC structure lends itself to heavy dilution of share value, through shares allocated to the Sponsor, the option investors have to redeem shares without surrendering warrants and the underwriting fees based on IPO proceeds.

This in effect impacts the actual value of the SPAC’s shares at the time of merger, further affecting the deal value and could result in lower share prices post merger.

Considering the large number of SPACs being launched and allegations against some of them, it is no wonder that there is rising scrutiny and this is welcome. There are calls for better disclosures and greater checks on Sponsors so theyhave more responsibility towards investors. Better regulations will weed out the unscrupulous players and lead to better outcomes. The increased competition among SPAC Sponsors for investor money is also resulting in more equitable structuring, ensuring Sponsors do not have an extraordinary advantage over later investors.

That said, the SPAC space still has a bit of the Wild West about it – with elements of high risk, potential for spectacular windfalls and less rules all intertwined. Investors will do well to keep this in mind when they go SPAC-ing.