How family offices are strengthening the Indian startup ecosystem with investments

Family offices are an idea whose time has come. Several factors have led to their increase, both in terms of absolute numbers and the scope of activities carried on by them, over the last few years. Previously, it was commonplace for business families to co-mingle business and personal assets, in addition to adopting unhealthy governance practices such as evergreening of loans. Since the introduction of creditor friendly laws such as the Insolvency and Bankruptcy Code in 2016, families are particular about the safety of personal assets and keen to put in place structures to preserve and grow them. The pandemic has also provided an impetus to families to organise themselves and their wealth better, which in turn has provided a boost to family offices in India.

Another factor contributing to their growth, has been the recent spate of initial public offerings and acquisitions, which have created a new category of first generation ultra-high net-worth individuals. These individuals are frequently young and first-generation entrepreneurs who are willing to evaluate evolving concepts such as the family office. Therefore, family office structures, which help business families and ultra-high net worth individuals professionalize and institutionalize the management and holding of personal wealth, are in demand like never before. By some estimates, there are over 200 family offices in India today[1], and by 2025 it is estimated that around 30% of the estimated $100 billion to be raised by startups shall be invested by family offices.[2] These are numbers that are only expected to grow.

How family offices are structured

In their traditional form, family offices were entrusted merely with the management of wealth. However, in their modern and more expansive form, they are responsible for a much broader range of activities such as lifestyle management for their clients, managing the education requirements of their children, assisting with rent collection etc. How each family chooses to accomplish these objectives, and the structures which they adopt, depends on the specific needs and preferences of the relevant family. Families in the early stage of planning frequently begin with an embedded family office model, where they identify persons who are already within their organisation or who are well known to the family, to begin managing the family’s personal wealth. While this option does offer the comfort of familiarity to the family, it may not always be possible for families to find suitably qualified specialists for their specific requirements. The choice then is between setting up a single-family office model versus opting into a multi-family office model. If the family wealth is significant, and if the family prefers to set up a dedicated structure for family requirements, they may put together a single family office team to manage family wealth. This team would be given the limited responsibility of financial management, or a broader set of responsibilities such as estate and succession planning, philanthropy, family governance etc. depending on family requirements. Alternatively, the family may work with a multi-family office setup which offers the same services, in the capacity of a professional advisor, to multiple families. This option comes with the advantage of providing access to large and qualified teams of professionals for the various requirements that a family may have at different points in time, in addition to the benefit of experience that the team may have in the course of working with other families who may have similar issues. Multi-family offices are also frequently less expensive.

Families contemplating the choice between single and multi-family offices are frequently concerned about hidden costs that may arise if a third party is entrusted with wealth management. In this context, it is relevant to note that in July,

2020, the Securities and Exchange Board of India (SEBI) introduced regulations governing registered investment advisors, whereby it barred providers from offering advice and distribution services to the same client. Through these regulations, SEBI also prohibited non-registered advisors from referring to themselves as wealth advisors or independent financial advisors. Reputed multi-family offices now operate on a fee only basis, and some have been doing so since much before the introduction of regulations by the capital markets regulator.

When families look to set up a single family office, they sometimes do so through the setup of a separate entity where the family office functions are housed, in addition to assets being held from a succession planning perspective. This entity is frequently set up as a private trust, and occasionally set up as a limited liability partnership (“LLP”) where different family members/branches may have a share. In setting up any kind of dedicated structure, families would first need to decide the objectives to be fulfilled by such a structure – whether the professionalization of personal wealth management, succession planning and seamless transfer of wealth to the next generation, centralization of decision making in relation to family assets, protection against future estate taxes etc., based on which the most appropriate structuring option maybe decided upon.

How family offices invest

Traditionally, business families tended to prefer investing in fixed income assets, real estate or gold, or setting up new family businesses. The professionalisation of personal wealth management over the last decade, combined with the growing role played by next-gen family members and developments in the economy, has led to business families and high-net worth individuals looking at alternative categories of investments as well. They are now actively participating in the securities market, investing in startups, setting up or investing in alternative investment funds or other Indian or global venture capital and private equity funds, looking at areas such as impact investing and even evaluating asset classes such as cryptocurrency and art. As this Survey Report finds, listed securities account for almost 36% of the total asset allocation, followed by fixed income assets at 20% and startups/venture capital assets seeing an 18% allocation in 2020-21.

Interestingly, the offices surveyed consider direct startup investments/Indian equities, venture capital investments and developed market equities to be the top three highest conviction opportunities in the next three to five years. Some family offices are also examining debt investment opportunities, especially in cases where there is a reputable issuer with a good track record, if there is also an offer of a decent return and terms. In deciding on the choice of investments, families primarily base it on a well thought out investment strategy that best meets their specific requirements, while also keeping in mind the various laws applicable to different kinds of investment structures as well as jurisdictions.

For example, families looking to diversify their investments outside India, are often limited by the applicable outward remittance by individuals which is only USD 250,000 a year, under the Liberalised Remittance Scheme route. An alternate route, known as the overseas direct investment (“ODI”) route, does allow an Indian company or partnership to send out a higher amount — up to four times its net worth, based on the last audited financials. However, the ODI route is only available for specified kinds of investments in a joint venture or wholly owned subsidiary which carries on an eligible business activity. This route cannot be used to make investments into listed securities, for instance, or any activity considered to be in the nature of real estate business or financial services.

Mature family offices also look to set up alternative investment funds (“AIFs”) to pool private family capital. AIFs set up in India are permitted to invest in equity or equity linked instruments issued by venture capital undertakings outside India, subject to a maximum limit of 25% of the AIF’s investable capital being invested overseas. The permission to make such investments is granted to SEBI registered AIFs on a first come first served basis, and is subject to other conditions such as the investment being permitted only in entities with some form of Indian connection, which is expected to generate indirect benefits to India. When it comes to Indian investments, AIFs are commonly considered as a way for multiple family branches or UHNIs to come together to share risk and costs and mutually benefit from underlying investments, while also pooling funds to enable the hiring of high quality professional talent.

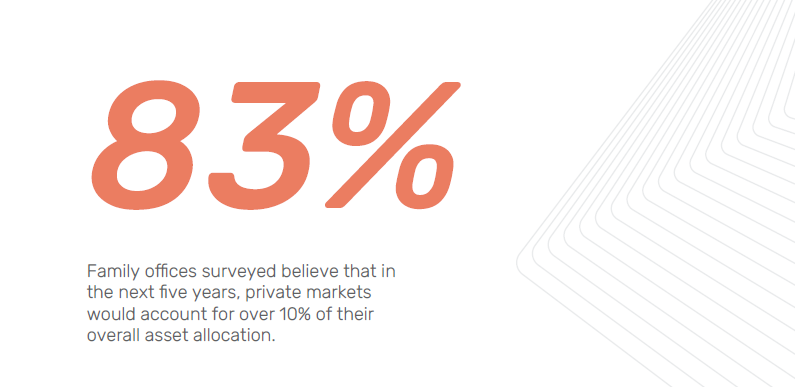

Even as families consider different structures and ways to diversify, this Survey Report finds that direct startup investments and venture capital/private equity investments make up 47% and 32%, respectively, of the total private market portfolio of family office investments. More than 83% of family offices surveyed believe that in the next five years, private markets would account for over 10% of their overall asset allocation. Recent economic developments are proving them right to focus on these areas. As of November 2021, India has 78 unicorns and over 55,000 startups with some of the most successful ventures emerging in the technology space. As the Survey Report also notes, financial, enterprise, consumer and frontier technology industries are likely to be the sectors which are of the highest interest to family offices.

It is already common to see marquee family offices co-investing along with well-known venture capital and private equity funds into the startup space. Sometimes, we see family offices also being preferred to venture capital funds, as providing more patient capital and strategic benefits to the investee company. At the same time, family offices are also evolving to realise that these investments are uncertain and risky with 20% of those surveyed terming the perception of high-risk associated with such investments as being one of reasons for not venturing in private markets.

The Bottom Line

As recently as a decade ago, it was commonplace to find ultra-high net worth individuals and well-known business families with no comprehensive plan in place for their personal wealth, often with unfortunate consequences. Thankfully, the tide is now shifting. Families are now consciously taking out time to discuss important issues relating to family governance, intergenerational transfer of wealth, business succession planning as well as the management and preservation of their assets. This is a timely and necessary shift.

This is because, India ranks third in the world in the list of countries with the highest number of family-owned businesses, the majority of which are in their third generation. Evidence from other countries also shows that most family businesses split up beyond the third or fourth generation, which often results in a loss of value.

Family offices are both a much-needed intervention as well as an indicator of the seriousness with which families are now considering the issues of succession and personal wealth planning. These structures enable families to get the best advice together, from legal, tax and accounting professionals as well as finance professionals, so as to decide the most suitable financial and governance strategies for the goals of the family, in addition to getting the basic housekeeping in place in relation to family assets, such as nominations for financial assets, preparation of a personal balance sheet, updated wills for all key family members and a cataloguing of material assets which are not in the nature of liquid assets or real estate. Hopefully this will enable families to transition their wealth better to the next generation, and assist in preservation of long-term harmony.