Investment trends under strategic shift

We often quote a popular saying by Greek philosopher Heraclitus, “Change is the only constant in life.”

The saying is particularly relevant when compared to the ever-changing private markets. Amid the uncertain markets, geopolitical concerns, and inflation, investors are reworking their investment strategies.

However, the ecosystem continues to adapt to the market changes and be resilient which is opening up the future opportunities for investments. Here are some trends to watch out for.

APAC on the investor radar

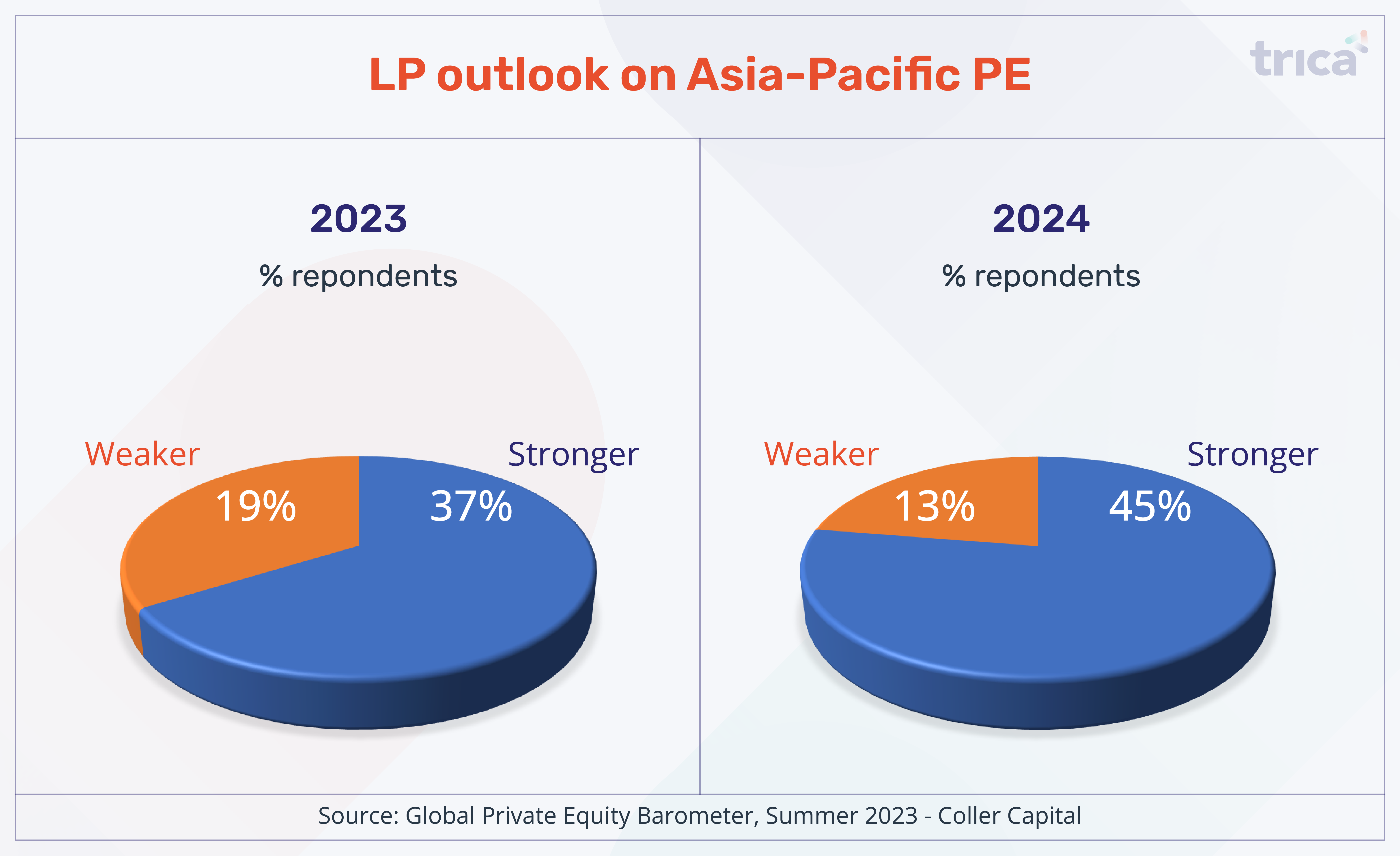

LP’s across the world believe that 2024 will prove to be a strong year for Asian private equity, according to Coller Capital’s latest Global Private Equity Barometer, Summer 2023. The report studied responses from 110 private equity investors based in North America, Europe, and the Asia-Pacific region (including the Middle East).

Of the total, 45 percent of the LP’s believe that 2024 will be a strong vintage year for Asian private equity.

The region allocation preferences are shifting for family offices as they focus on regions which have not been as popular in the past years.

As family offices plan for the next five years, they are looking to broaden their allocations in the Asia-Pacific region, according to the recently published Global Family Office Report 2023, by UBS. The report includes responses from surveys of 230 single family offices around the world with an average total net worth of $2.2 billion.

Family offices refocusing on alternative allocations

Several factors including market uncertainty, geopolitical concerns, and inflation have led the family offices to refocus on their allocations.

Data from UBS report suggests that allocations in hedge funds have recorded a rise from 4% in 2021 to 7% in 2022. Out of the total 230 respondents, half of them invested in hedge funds in 2022, up from 43% the year before.

On the other hand, allocations to direct private equity funds have declined from 13% in 2021 to planned 6% in 2023. Apart from this, the percentage of family offices who invested in direct private equity in 2022 also declined to 60% from 67%.

Respondents have revealed that family offices may maintain a neutral stance this year as many are cautious of the uncertain growth outlook in developed economies, tighter lending conditions, and heightened geopolitical tension.

Even though investors are wary of the uncertainty in the private markets, they continue to be bullish on its potential. The numbers beyond 2023 are expected to change as 41% of the family offices plan to increase their direct investments and 35% look to increase investments in funds / funds of funds.

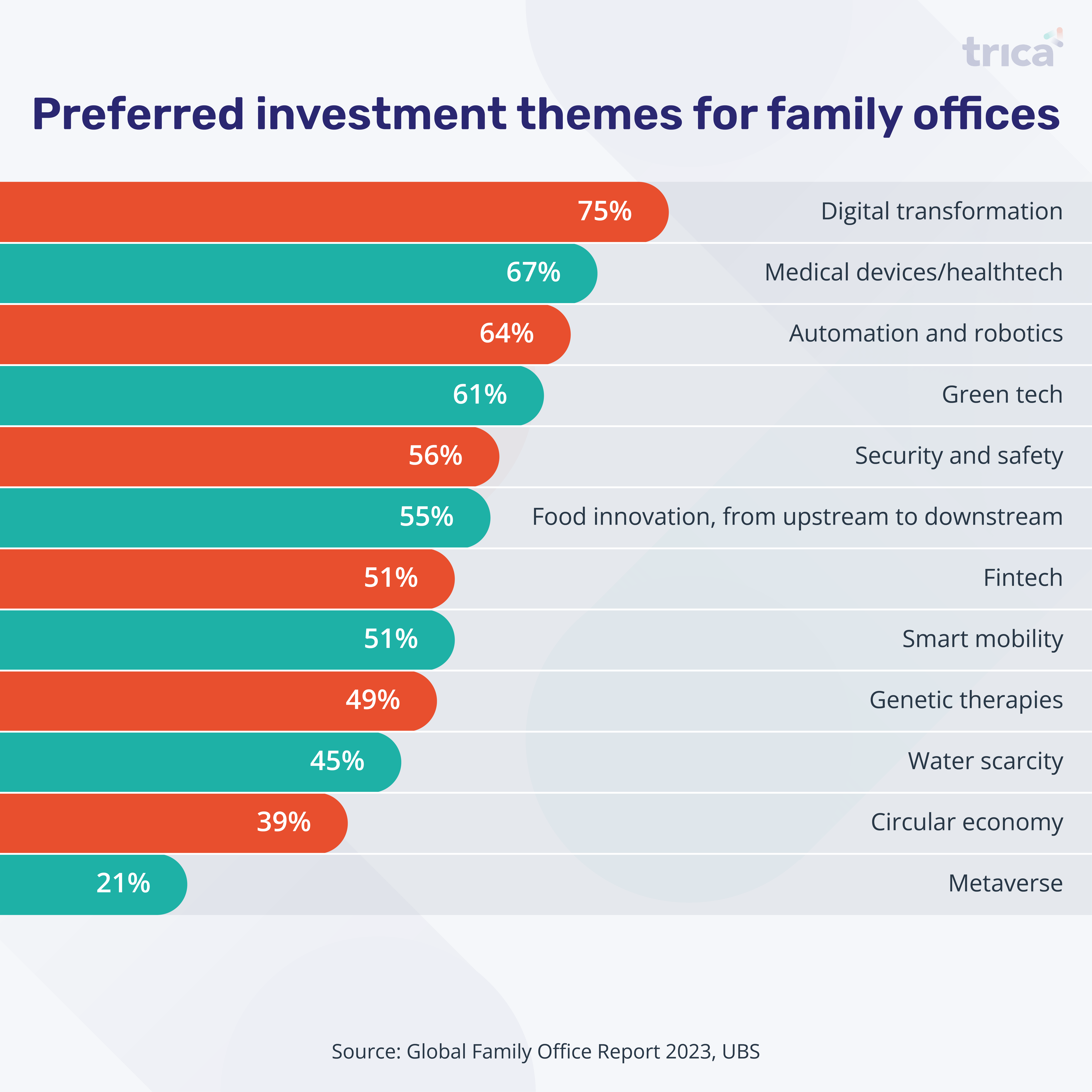

Theme-based investments still going strong for family offices

Theme-based investments continue to be popular among family offices. According to the UBS data, digital transformation emerged as the most popular with 75% of the respondent family offices stating that it is a possible investment area in the next two to three years, followed by medical devices / healthtech, automation & robotics, and green technology.

The data also showcases that theme preferences change according to the geographies as medical devices / healthtech was found to be more preferred among the APAC-based family offices while automation & robotics was more preferred in Europe.