Why Indian Startups Need Family Offices as Investors

Dr Aarti Gupta belongs to the promoter family of the Jagran Group, a business house with interests spanning across media & communications, education, real estate and hosiery exports. She heads the investment strategy for the family office and is the Chief Investment Officer at DBR Ventures, which invests in early-stage startups. She is also an investor on India’s first reality startup funding TV Show, Horses Stable.

Dr Gupta is the past Chairperson for FICCI FLO Kanpur and is currently serving as the National Head for FICCI FLO Start-ups, an ecosystem for women founders and funders. She is also the Chairperson of the Startup Committee of Merchant Chamber of UP.

An Economist with a PhD in “Borrowing and Lending Behavior of Households: Impact of Loan Waiver Program in India” and a post-graduate diploma in business studies from Harvard University, Aarti “accidentally” found herself in the investment space. She is also an active angel investor now. Speaking to trica’s Syna Dehnugara over a Zoom call recently, she shared her thoughts on investing in Indian private markets.

From an economist to an investor and fund manager, what shift did you have to make in your head? How much of a switch does it take to move from one side to the other?

I casually started looking into our family investments while pursuing my PhD, about 13 years ago. Most of our investments were into insurance policies or fixed deposits.

It was not a switch; I gradually got involved with the investment decisions, understanding the family’s goals and objectives, and then creating the portfolio of investments and defined systems and policies for our investments for a family office.

But I’ve always been a numbers person; so that part was not difficult. I have a degree in Finance; numbers excite me. I think the larger switch was getting into the private markets; the public market was easier. I had to do a lot of reading, meet a lot of people, network, and understand the private market ecosystem.

How do you read the current global situation? Do you believe that India will stay isolated to a certain extent from some of the headwinds emerging out of the US?

In the last three years, we’ve experienced scenarios like never before. With the inflation and interest rate rise, macro indicators are pointing towards a recession in many countries; somehow, India has been protected till now. But we are very cautious about this in our investment strategy this year.

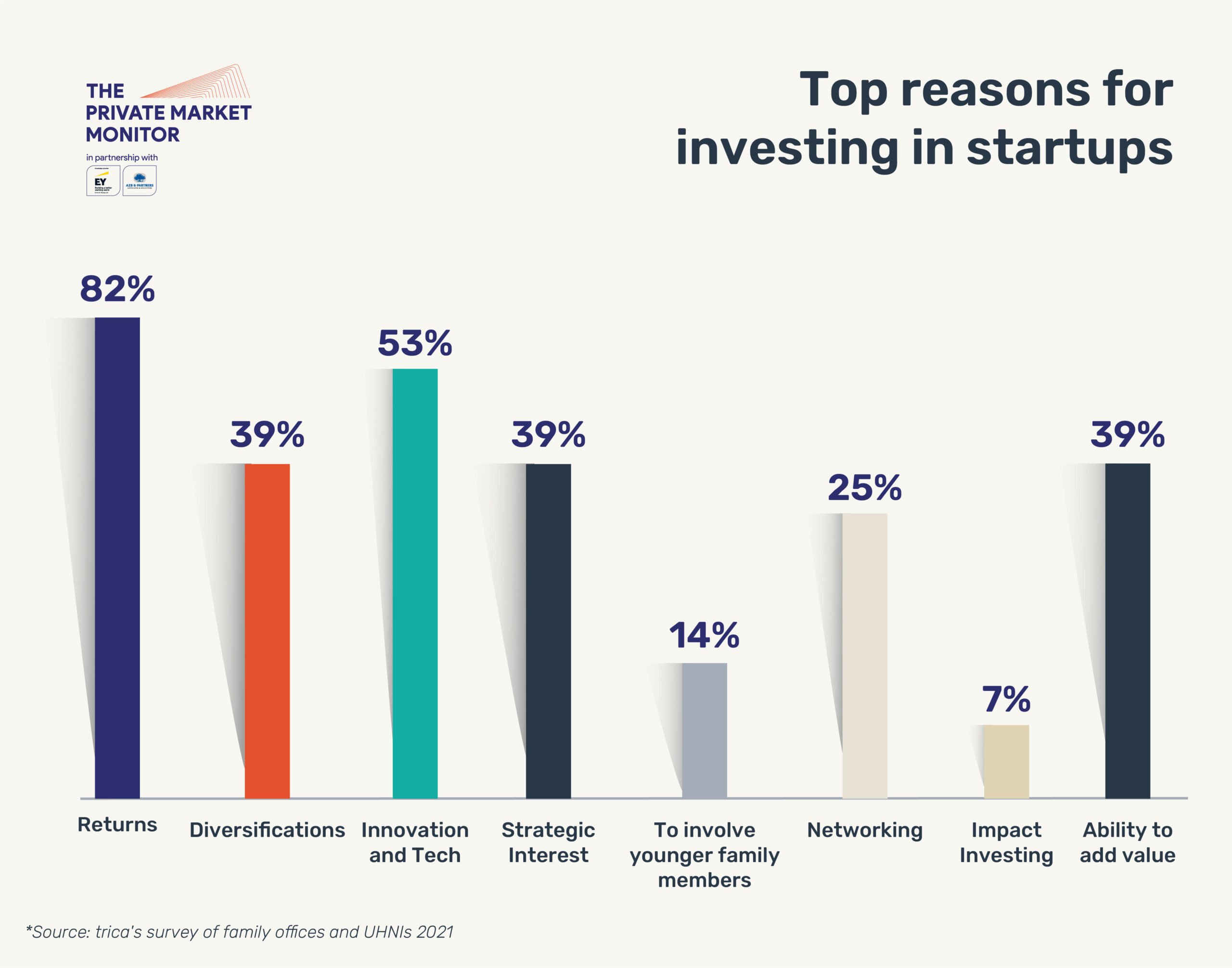

However, I’m extremely bullish on India. The kind of government, consumer, companies, and innovation coming out of this country is unlike any other. The Indian private market is still at the beginning of massive growth. As a family office, we’re looking into those opportunities.

When exactly did you start making private market investments? How has it changed over time?

We started looking at these opportunities about 7 years ago. The fixed income returns were squeezed; the public equity returns were at 12-15%. We started investing in different AIF opportunities and funds; it started off with pre-IPO investments and funds, then early stage funds, and later VCs. As we understood the market better, we started investing directly too.

What were some of the temperament changes that you had to make, as a family office? Did you prefer investing in sectors/companies that you understood well?

Temperamentally, I think the family is still a little wary of private markets, because we’re yet to see ROI, especially in investments into funds; most funds are on a 10-year horizon. For the older generation, it’s not a return till the money hits the bank. But everyone understood that we need to make this transition; otherwise we might get left behind.

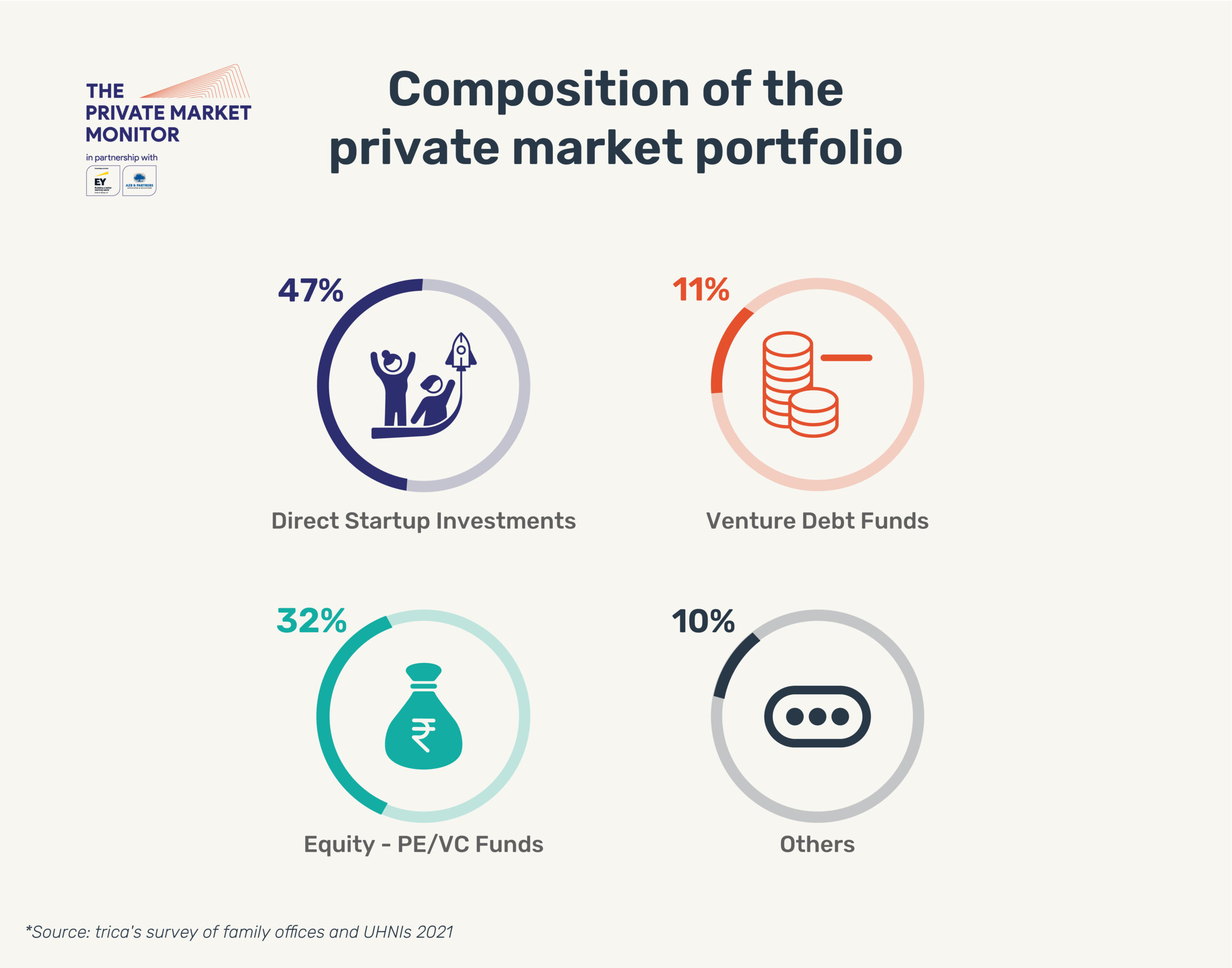

We started with investing into pre-IPO funds since they seemed to have the shortest duration in terms of liquidity; the majority of our allocation started with DCMP funds.

Public and private market investing have different benchmarks. When we started exploring this asset class, we wanted to invest with the best fund managers and learn from them. Investing directly into startups is a personal passion; but I lacked prior experience in private markets, so I thought it was best to make those connections before starting direct deals.

Now that you’ve learnt more by investing directly, how do you see the mix of direct investment and investment via funds evolving?

I like to invest directly if it’s a sector where I can add value to the company or founders. Otherwise, investing through a fund is better. Currently, 70% of our investment is done via funds and the rest directly into startups. In the next two years, it would be closer to 50-50.

How does your investment office do the due diligence and understand the sectors you are investing in?

Our team is small; the majority of the administration and accounting work is done by the corporate head office. But we have the right mix of advisors and analysts on board. We have created a solid investment thesis around a filtration mechanism – on certain sectors, do’s and don’ts, and the kind of deals we need to avoid too. Because once you are looking to invest in startups, you get 10-odd pitches a day. But to get the right deals, you need to make the right connections. Otherwise, you could still end up missing the “best deals”. It is also important to track your deals, be in constant touch, and measure the performance of the company. We’ve decided the metrics to be measured quarterly, and we have set up a system of meeting with the founders often to see if they need hand holding. This helped us make the shift to directly investing into startups.

What are the components of your family office’s investment thesis?

We are looking for companies which are solving a large problem, with a market size large enough, and have the potential to become market leaders. We are bullish on consumer tech, space tech, and biotech. We support women founders, and founders who are trying to solve problems pertaining to women. But overall, we’re sector agnostic.

Why do you think women entrepreneurs rarely raise funding beyond Series B?

Globally, women founders raise funding much lesser than their male counterparts. But this is changing in India. Today there are funds focusing on women founders. There are fantastic women founders who are in their early stage now, who will be raising funding and soon be listing their companies.

A recent study by Harvard found that VCs asked promotion-oriented questions to the male entrepreneurs, and prevention-questions to women founders. (When men pitch startups they get asked how they’ll make money. But women get asked about how they’ll prevent losing investor’s money.)

I tell my female founders that if you ever get posed a prevention question, give a promotion-answer; that could decide if you get the funding or not.

When you talk about investment and strategy with your founders, do you also talk about D&I and ESG factors? Have you felt that it should be made into a strict policy?

Many are already talking about D&I and mature ones are actively incorporating them too. But in early-stage startups, where I invest, they are usually struggling in terms of team building, so I don’t want to add another restriction.

In terms of ESG, every individual should back businesses that have ethical, social and environmental footprint, as a consumer, investor or as a founder.

Nobody else is going to come and save our planet! One of our export companies in fashion does 50% of production with organic and sustainable fabrics.

LP groups globally are now stringent on D&I within their own teams as well as their portfolio companies. Do you think that LPs in India can exert that pressure on domestic funds?

If your investment office does not have a diversified team, you’re missing out on major markets. If, say, you don’t have enough women on your team, you’re missing out on understanding 50% of the population – i.e. 50% of the market. If someone’s pitching you a new hairdryer, you’re never going to understand if it’s revolutionary or not unless you regularly use hairdryers! So it’s very important to have a well diversified team, and we have a long way to go. This is not a part of the investment decision yet in India; but we will get there. Recently, a study found that women-led funds outperform the male-led ones. It’s not charity to get more women on the team; it’s because you’re seeing results.

INSERT here: PMM GFX (p40): Highest conviction opportunities in the next 3-5 year

What are some of your questions to founders pitching to you? How do you understand how and why they are building what they are building?

I ask – What is your moat? The answer gives me an insight into what the founder thinks, their USP, and why they think they will succeed.

I also ask how they came up with this idea. That gives me an understanding about the founders’ journey and passion.

Furthermore, I ask about the roles of different team members to get an insight into how dependent the company is on the founder, and the relationship between the team and the founder.

Also, understanding the short term and long term usage of money tells you the potential of the company and the founder’s vision.

A lot of founders take the entire universe as their market size. But it is very important, especially at an early stage, to identify who your target audience is, because only then can you scale up. So the founder needs to have clarity on the product-market fit.

In the last two years, we saw private players like Nykaa, Zomato, and Paytm list on the stock exchanges. Do you believe that these companies were ready for the public market?

In the last couple of years, IPOs grabbed a lot of interest. But since then, they have plummeted in value and lost crores of retail investor money. So, investors will be cautious for future IPOs.

This is a sign for startups to attempt profitability from a much earlier stage, before they hit the exchanges. Because once they hit the exchange, they are at par with traditional, listed companies and will be measured with the same metrics.

A startup exchange as the first step – before listing on the main exchange – may not be a bad idea; but the transition has to be smoother. Funds need to prepare these companies for the same. Now regulators will be more cautious before giving permission to list.

Family offices have built strong, mature businesses – listed or unlisted – that have been running profitably for decades. Do you believe that early-stage startup founders will get better guidance in building their business from family offices (who come on board as investors) than typical VCs who push for growth?

Family offices have more dry powder and patient, long-term capital. They also have the experience – because most of them have listed companies! So someone in the family has gone through the cycle of going to IPO, meeting shareholder expectations, and maintaining value on the exchange. Thus there is a lot more value-add to getting a family office on board, especially when you’re in the later stage. Once founders see the value family offices bring on board, I think they’ll be able to grab even better terms and valuations.