Where are the world’s rich investing?

The markets are changing and so are the investment trends. Over the last few years, investors have shown increased interest in the private markets, including family offices who have been traditionally known to prefer the public markets.

The opportunities in the private market is undeniable and thus there have been several new entrants to the market in recent years. One of them taking the lead being family offices.

While family offices in the past have been inclined towards the private markets and low-risk assets, the trends seem to be changing. The wealth making opportunities along with the technological disruption could be one of the reasons behind the shift.

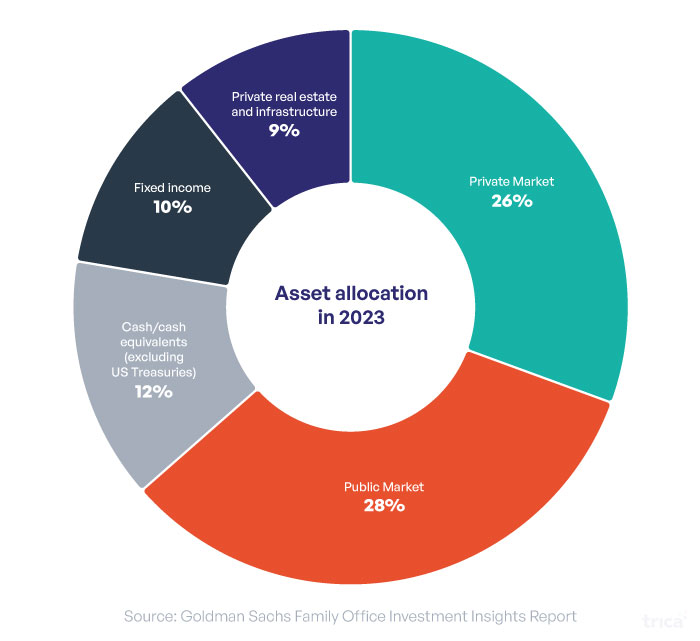

In a recently published Goldman Sachs Family Office Investment Insights Report, ‘Eyes on the Horizon’, data revealed that average asset allocation by family offices towards private equity increased from 24 percent in 2021 to 26 percent. This data showcases continued interest from family offices across the world towards private market investments.

Meanwhile, allocation for public equities decreased from 31 percent to 28 percent. With increased allocation to high-risk assets, family offices have also taken steps to balance out the risk. The survey revealed the respondents have also increased their combined allocation of cash and fixed income from 19 percent in 2021 to 22 percent.

The report highlights results from the survey of 166 institutional family offices across the globe, including Americas, EMEA (Europe, the Middle East, and Africa) and Asia-Pacific (APAC).

However, the current market conditions have raised multiple concerns among the investors. According to the survey results, recession, geopolitics, and inflation have been identified as the top three concerns. While a higher percentage of family offices from APAC are concerned regarding the impact of geopolitics, EMEA and Americas have expressed their concern for inflation.

Interestingly, even amid the concerns, family offices continue to be bullish on private markets. As much as 41 percent of family offices are looking to increase their private equity allocation in the next 12 months with only 13 percent looking to reduce it. Meanwhile 48 percent of the respondents are planning to increase allocation in public market equities.

At the moment, the US takes a whopping lead as the top market with an average of 63 percent capital allocation by global family offices, 21 percent to developed countries with only 2 percent going into India. However, the sentiments seem to be changing slowly and steadily with respondents considering increasing allocation in India by 14 percent in the next 12 months.

India is also reflecting similar trends with family offices increasingly betting on the private markets. According to trica’s 2021 survey of 103 family offices and UHNIs, “‘The Private Market Monitor,” over 83% family offices allocated over 10% of investment to the private markets. The allocation percentage has doubled for about 40 percent of the respondents.

Exposure to new tech and innovations was cited as the second leading factor behind investing in startups after non-linear returns by the Indian family offices.

Family offices tend to make growth-oriented investments with an inclination towards businesses that have the potential to endure the business cycles. In the survey, 43 percent of the family offices stated that their portfolio is overweight in information technology and 34% consider their portfolio to be overweight in healthcare making them the top two sectors.

Sustainable investments are also a major area of focus for family offices with 48 percent of the respondents directly investing into businesses solving social or environmental problems. Within this, clean energy is garnering maximum interest with 60 percent planning to allocate capital in the sector in the next 12 years.

Disruption in the digital asset segment has been attracting investor interest. Bullish on the digital asset segment such as cryptocurrencies, blockchain, stablecoins, non-fungible tokens (NFTs) among others, 32 percent of the total respondents are now investing in digital assets. This is a significant leap from 16 percent in 2021.

Surprisingly, at the other end of the spectrum, investors who are not investing in the digital asset segment have also increased.

It is often believed that a crisis opens doors to opportunities and that might just be true for the global markets. For family offices, this could be an opportunity to invest and build the future.

(Featured image: Unsplash)