The sound of India’s entertainment market

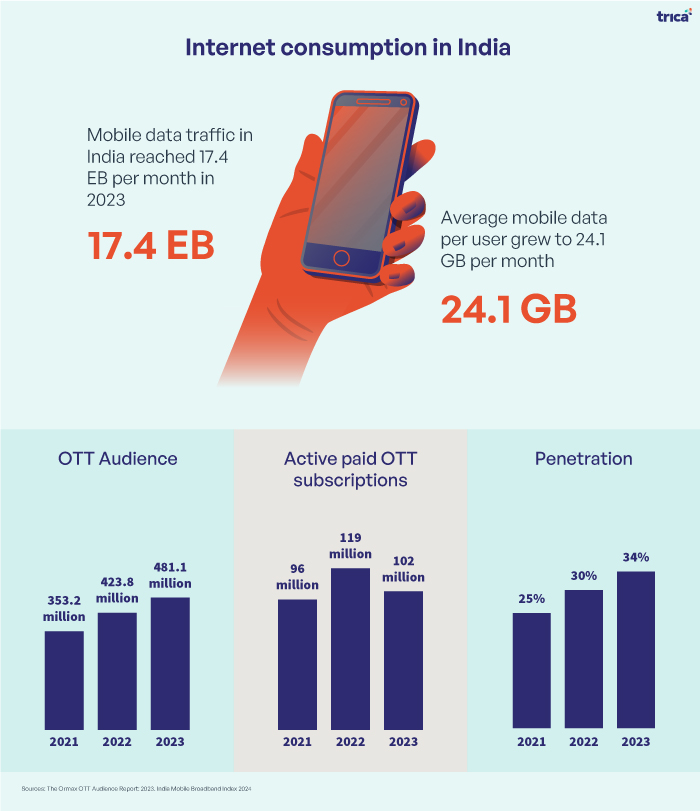

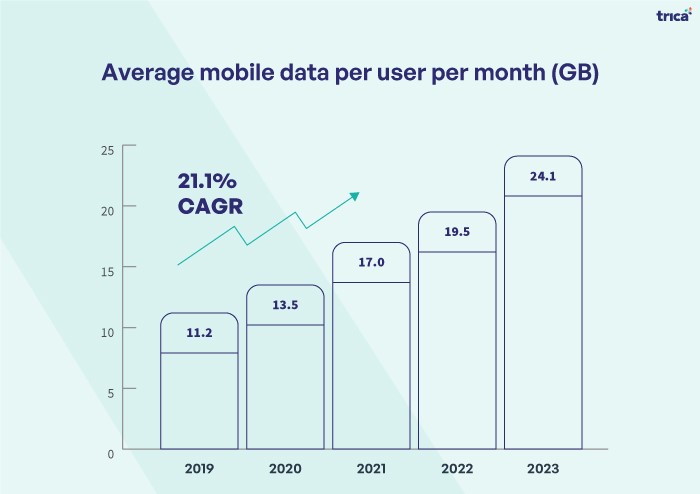

India consumed 17.4 EB of mobile internet data in 2023. That is 174 trillion GB or more than 17 million TB worth of content transmitted throughout the year as we scrolled through social media reels, binge-watched the latest shows, or perhaps played a couple rounds of World of Warcraft to unwind after a long week.

It is not surprising then to learn that Indians with phones spend around one fifth of their waking hours on apps, mainly social media, OTT platforms, and online gaming, as found in a study conducted by IIT Ahmedabad last year.

Behind the digital curtains, modern day businesses like Rusk Media are at play, creating gripping experiences with new media.

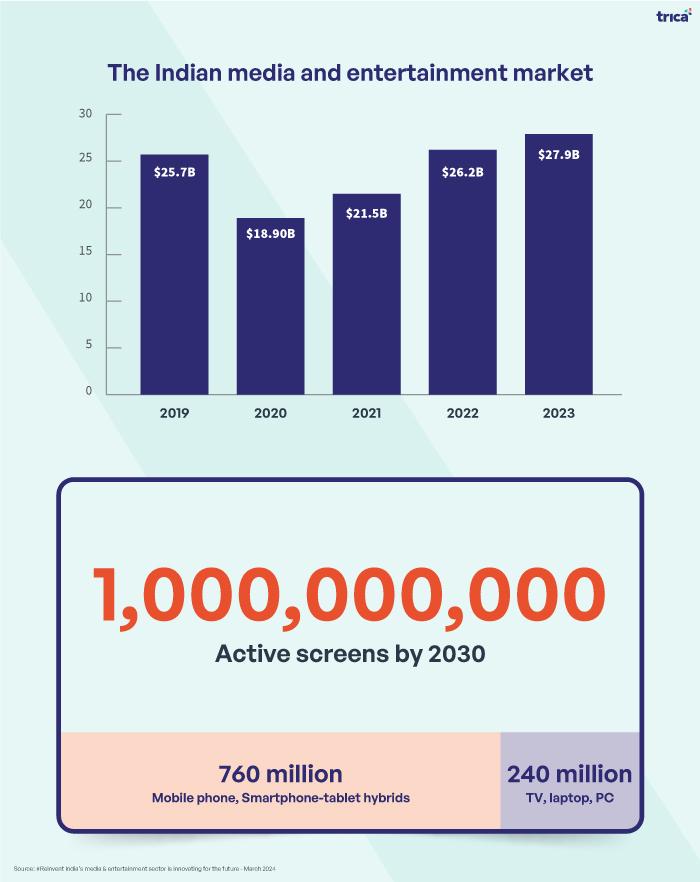

As far as personalized screens for youth entertainment is concerned, India skipped the ‘laptop revolution’ and the use of smartphones enabled personalized screens and entertainment, says Mayank Yadav, CEO and Director, Rusk Media. The country is now expected to have one billion active screens by 2030. More than 70% (740 million) of this will be small screens like smartphones and phablets.

India’s media and entertainment market touched $27.9B, which is 21% above pre-pandemic levels in 2019. It registered eight percent growth from the previous year, driven mainly by new media – comprising digital media and mobile gaming which led 52% of the total advertising revenues in 2023.

Blurring Boundaries

Even in new media, the boundaries are blurring with platforms like Netflix prioritizing interactive gaming by rolling out select gaming titles for free to subscribers as well as key hiring to boost gaming.

The numbers coupled with heavyweights like Mukesh Ambani’s Reliance making a slow and steady entry to the OTT market points to a lucrative market opportunity. The conglomerate is reinventing its business in India’s entertainment world. Through strategic partnerships, Reliance got Uday Shankar – media maverick who launched Hotstar in India – to bring JioCinema out of its shadows of its existence since 2016.

This week, the OTT platform introduced the cheapest pricing yet for premium content: A monthly subscription for Rs 29 (Re 1 per day) for individual plans and Rs 89 for family plans for 4K streaming quality.

This heated market presents a big opportunity for content studios and players in the value chain who are empowering OTT giants with rich and authentic content, especially as Indians seek relatable and quality regional entertainment.

To help these entertainment platforms serve the choicest content, Delhi-based Rusk Media takes a data-driven approach to figure the kind of shows and movies that work. It then teams up with relevant writers and directors and serves the content that hits just the right note with the audience.

Rusk creates shows for the likes of Amazon Prime Video, JioCinema, and Hotstar, among others, clocking 600 million to 700 million reach in distribution. Such direct sale of content to OTT partners makes up about 70% of its revenue.

Thanks to deepening internet penetration and avenues for innovative monetisation, Rusk Media and others like Mumbai-based Pocket Aces are tapping unique business models by leveraging existing platforms like YouTube.

They set up targeted and value-driven entertainment channels, build the brand for specific target audience (Young adults, food and cooking enthusiasts, gaming community) and engineer videos that get multi-millions in viewership and engagement. These brands also earn money from brand partnerships for product placement. They harness the creator approach at scale.

The popularity of social media publishing, online gaming, and OTT platforms will continue to make entertainment a thriving market. However, audience preference is constantly changing and the kind of entertainment properties that will become mainstream in the next decade will be different from what we see today. New-age content studios with their ear to the ground, close to Gen Z and Gen A, reserve the right to win.