Investing in startups is the right CSR: Ullas Kamath

Ullas Kamath, former Joint Managing Director of Jyothy Labs, is one of the few Indian private market investors who have seen the evolution of the country’s startup ecosystem since its inception. He is clear about why he invests, what he looks for in an investee, and what he will not compromise on.

In a fireside chat with trica’s Jignesh Vora at the Bangalore edition of trica Inner Circle – an exclusive forum for peer-led conversations about private markets – held a few days ago, Kamath shared his thoughts and lessons as an investor.

Why did you start investing in the startups?

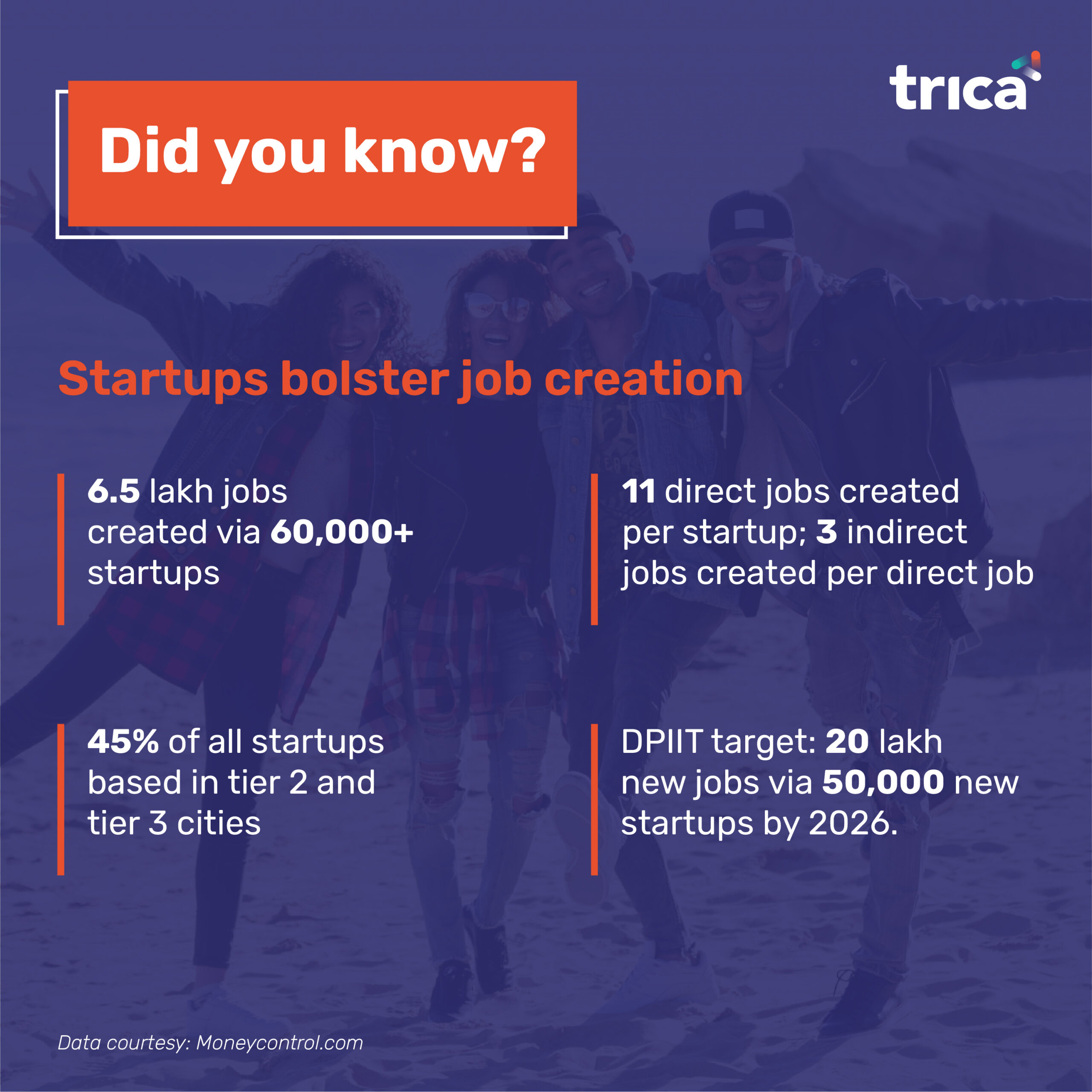

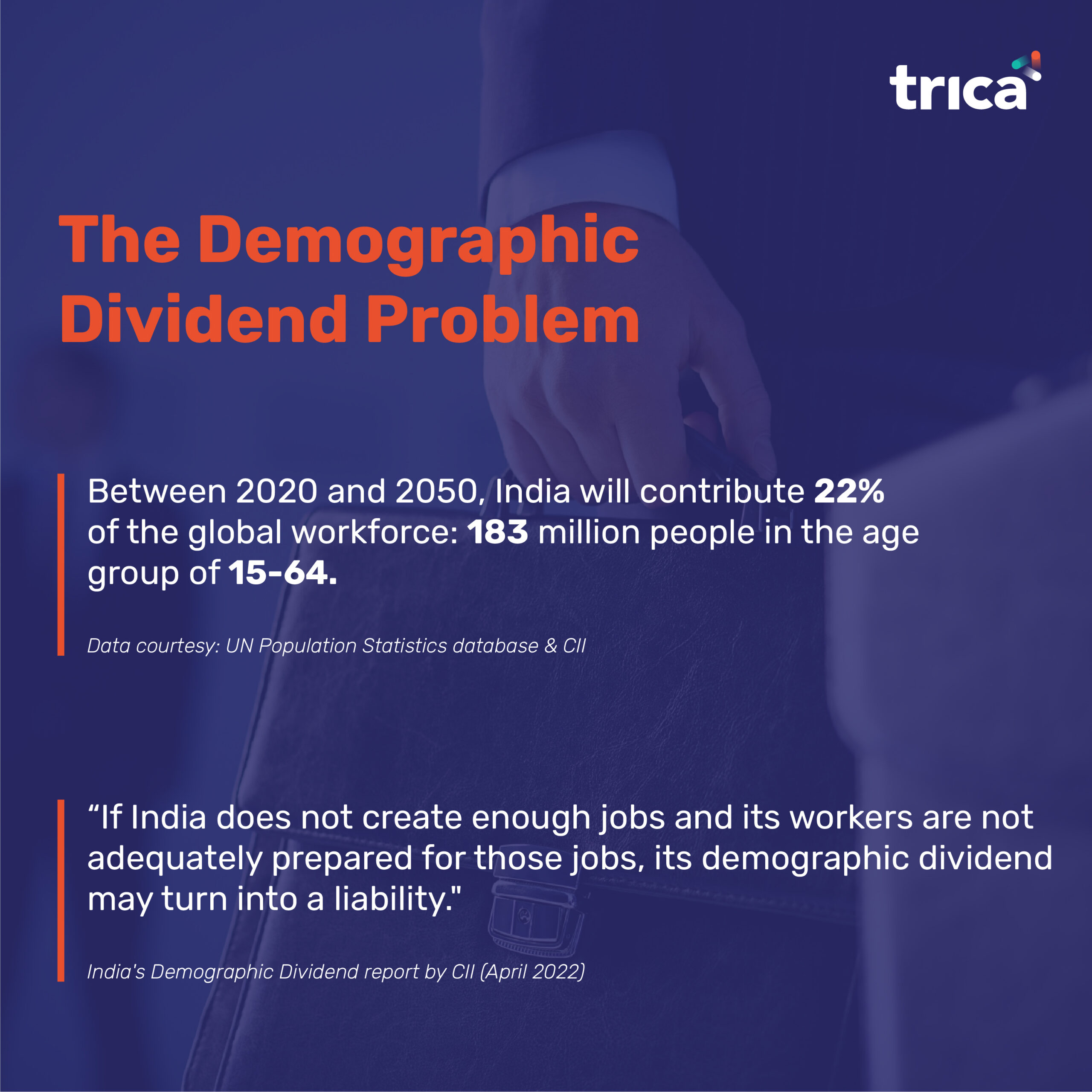

For me, investing in a startup is the right CSR. Today’s corporate responsibility is to create jobs. India needs a million jobs every month, how many companies are taking the responsibility? If you can’t create the jobs, please help startups to create the jobs; invest in them. So, when I say Corporate Social Responsibility, it is not from 2% of the profit after tax.

It is our duty to encourage startups, because at some point in time, we were also startups. At that time there was no encouragement; there was only discouragement, including from family members. Encouraging an entrepreneur demands you to invest money and time. To start up is to take a big risk emotionally. And that is where we need to support entrepreneurs.

What are your key learnings over the last 10-15 years of investing in startups?

Every startup comes with one core competence. You need to identify it very quickly, and you need to build only on that.

I try to recognize the strength of a person, and work on that. And that one core competence is what makes him or her a star. I don’t look at weaknesses; everyone has some weakness.

When you talk to a founder as an evaluating authority, what are the questions in your mind?

Very simple. Look into his eyes and see if there’s a twinkle. Second – how much can he dream? Third – does he have a focus in his life? He need not have come first in class, but he should know his subject, remember his friends’ name, teachers’ name, college name.

How you build a team matters. You should build a team first, and then raise money. I tell (early stage) startup founders to get one good employee and start from there. Then they realise how difficult it is to get one employee and therefore funding will be that much more difficult for a startup.

This is what I look into – whether there is character, competence, and commitment.

I don’t invest in someone who wants to build a company to exit! If they’re building only to exit, they are not putting the best effort to build it.

The founder is the cornerstone for the startup. But what are the other criteria to evaluate a growth stage startup? What are the key things that are non-negotiable?

By the growth stage, founders should understand their customer segmentation very granularly and really know what is required in the market. Any disruption must lead to better, cheaper, faster, and convenient service or must not be undertaken

The thing which I don’t compromise on is that the business plan cannot change on a monthly basis. Take three months to put a business plan together, but it cannot be changed every quarter saying that the situation has changed. Situations will keep changing.

And the quality of the team a founder has built to get to the growth stage shows his quality. I love a startup founder who brings in people who are better than himself.

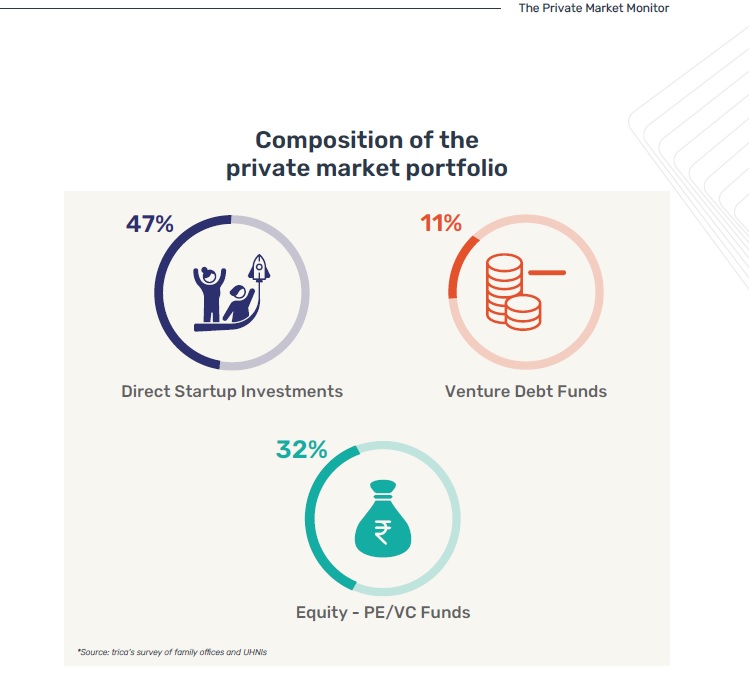

There are various ways to invest in a startup – like via a fund or AIF, or direct investment. What is an ideal portfolio? Are things changing from how they were five years ago and which direction is it heading in now?

I think a combination works best. Direct investment of, say, 30-40% could be beneficial because then you know the pain of running a startup. By investing in a VC fund, you will never see that. You may put another 30% in a VC fund, then you will realise how beautifully they manage the funds invested in companies, what kind of SOPs they have, and what they do. You will get returns, you will get to understand what works, and how they get the exit.

Take the lessons from there (the VC fund) and put it in your own investment office.

What are the key things one needs to do when one is setting up an investment office?

You can either directly invest in startups or put money in a VC fund, or have a combination of both. Having your own fund is the future; offices of HNIs and UHNIs will have funds of their own soon. They will have professionals to manage too, or aggregated family offices will manage your funds for some fees. trica has come up with a beautiful business model which is unheard of anywhere.

If your portfolio is beyond Rs.100 crore, it’s better to have your own small fund to start with, because setting up can cost us about 2-3%. With Rs. 2-3 crore, you can build a small team to deploy the capital.

I see plenty of opportunities to have small funds over a period of time. You can then link that fund to your economic engine so that you get regular profits. It will be the most tax efficient method to deploy the money.

In the last year we have also seen some of our largest private companies transition to the public markets. Your thoughts on the cross over – lessons learnt and road ahead for investors?

Once startups get listed, they lose the charm.

My recommendation: don’t go public quickly. If you do it right, you will have investors. If you see continuous profit for, say, 12-16 quarters, then you go public. I am not talking about the path to profit in 16 quarters, I’m saying 16 quarters of profitability.

Then you get value, you get respect!

At the end of the day, profit matters. I’m not saying that you need to go the Western way. We have learnt customer acquisition costs, customer retention costs, we have learned employee retention costs, all these things we have learned from the West.

Once you go public, you’re in public regulatory supervision all the time. If you do well, you have problems; if you don’t do well also you have problems. Even the best of companies, continuously showing profit, are still under pressure.

For a startup to get into that new area of public supervision, or regulation is a different ballgame for them to understand it very quickly, because you’re being asked – when will you become profitable?

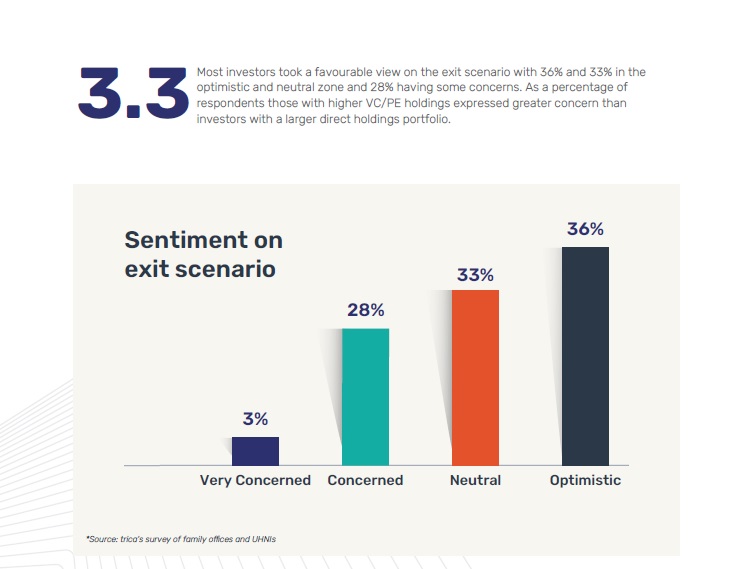

Exit is very important from investors’ point of view. Over the next couple of quarters, where do you see exits?

Good companies will always get exit. But they don’t want to exit because they are good companies. Second, you need a venture capitalist or someone like trica to tell the founders when to exit because they’re emotionally attached to their startups. The purpose of exit is to scale; or exit should happen when you can’t manage it any more. Exits for investors are different from that of startups. If there is an ecosystem for investors’ exit, more investors will come in.

Do you believe that there needs to be a rethinking of companies – as in, do you have to list at all? Why can’t companies stay private longer?

Once you go public, you’re in public regulatory supervision all the time. Even the best of companies, while continuously showing profit, are still under pressure. For a startup to get into that new area of public supervision is a different ballgame.

But once you’re profitable, it is easy to predict the growth.

Be conservative, under-commit, over deliver. People will respect you.

And a classic example is Infosys. I’m a fan of Infosys. For the last 25 years, I have seen how they set their own guidance – up to even the two digits after the decimal point (for profit). That’s the kind of predictability they have despite the global pressure. No company has ever given that kind of clarity every quarter. I want every startup to keep that as a benchmark.