Fintech: The evergreen sector on every investor’s mind

Fintech’s first identity is the QR code – at least for the common Indian who finds it everyday in their local kirana store, on roadside carts stacked with socks and dreamcatchers on display, or even stuck on the chest of their idol in temples to make daily offerings or donations. In fact, the natural reflex now is to scan and pay, not to take out the wallet, pay with cash, and wait for the change.

People took this convenient and widespread mode of payment as a sign of India’s arrival in the modern, digital age – and rightly so. Today, more than 300 million people and 50 million merchants transfer money online instantly. Rapid adoption of paying through smartphones came especially during demonetisation in 2016 and the pandemic when social distancing was the word of caution.

Today, however, a wide variety of tech innovations empower the fintech landscape, including blockchain, Artificial Intelligence (AI), and Machine Learning (ML), among others. And payments is just one part of the larger fintech market. There is more to fintech than just sending and receiving money on our smartphones.

Other financial services like lending, wealth management, fintech SaaS, insurance, and neobanking too, are showing much promise with technology in the picture.

Digital lending on fast-track growth

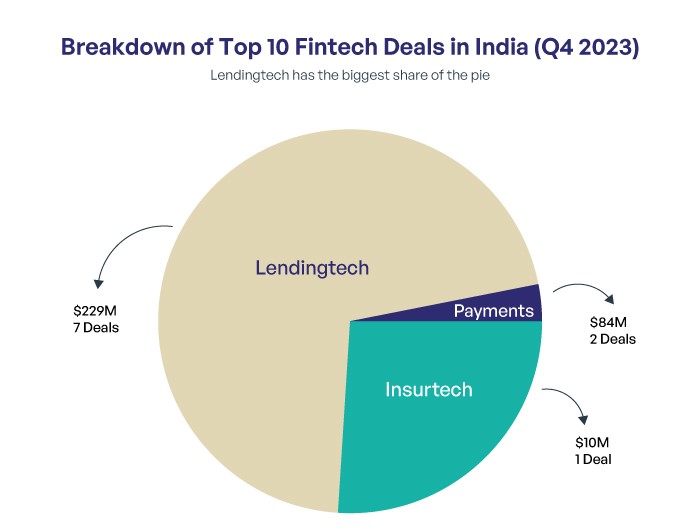

Lending tech is garnering investor interest. It drove seven of the top 10 fintech deals in the last quarter of 2023. By the end of the decade, lending is expected to dominate 60 percent of the fintech market opportunity in India, according to an EY report on digital lending. It has beaten payments as the top-funded subsector within fintech with $2700M and $1270M in 2022, respectively.

In the last five years, digital lending recorded over $9B in investments and further innovation in product and business models are expected to drive this segment to a book size of $515B by 2030. The overall lendingtech ecosystem itself is poised to become a trillion-dollar opportunity.

We’re like to get there through:

- Tech-first approach

- Robust partnerships, particularly in Small and Medium Enterprises (SME) financing and consumer lending segments.

For the SME audience, fintech is modernizing supply chain financing to facilitate more efficient cash flow and better working capital.

As far as consumer lending is concerned, startups are entering the race by pursuing Non-Banking Financial Company (NBFC) licenses – which allows them to mimic certain banking services like disbursing loans – or acquiring other NBFCs to offer on-book credit through partnership models.

It is not surprising then that digital loan disbursement through NBFC has increased dramatically from just six percent in 2017 to 32 percent in 2022. This is likely to continue trending upward as 75 percent of digital lenders are currently pursuing NBFC licenses, while the remaining 25 percent are considering the same.

Today, lending transactions have evolved from simple single layer execution between a borrower and lender to multi-layer execution involving fintech or embedded finance players, NBFCs, co-lending platforms, and co-lending partner banks, among others. Eventually, co-lending will emerge as a marketplace model that supports lending partners to mitigate their risk exposure.

Eventually, every company is likely to be a fintech company by nature. Even tech giants like Apple that rose to fame as the iPhone-maker has forayed into fintech space through its card and wallet apps. Closer home, consumer brands like Xiaomi and Ola have entered the digital lending market with MiCredit and Ola Pragati (in partnership with SBI) for loans, respectively.

A resilient market

Much of the fintech solutions are today built and innovated on top of Digital Public Infrastructure (DPI), a robust foundation that has brought more Indians into the formal economy.

At its peak, fintech investments saw a threefold jump in 2021, raising $4.6 B in the first three quarters. While the cheque size went down during the slowdown, the sector raised the highest amount of funding ($460M) and second highest in deal count (31) in Q1 2024.

Funding is rebounding at a swifter pace than the global market downturn with 30 percent surge in capital momentum, outperforming the global growth rate of 8% observed in H2 CY22.

With increasing demand for fluid finance solutions, a robust internet penetration, and innovative public and private synergy in tech, the Indian market for fintech is fast expanding beyond the metro to tier II cities and rural areas that do not shy away from online financial services.

The opportunity is as large as it gets with studies anticipating Indian fintech to register $1T in AUM and $200B in revenue by 2030.