7 Things Investors Look for in a Cap Table

Investors are the ones who put in their hard-earned money into a business that they believe in. They do so with the expectation of high returns.

Other than returns, it is the responsibility of a company to show the details of investment in a neat and easy-to-understand manner to investors at any given point in time. This is done using a tool known as a Cap Table, which has several other advantages as well.

What is a Cap Table?

A cap table or capitalization table is a snapshot of the equity holdings of a company. It shows the percentage of equity held by every founder or investor and even employees

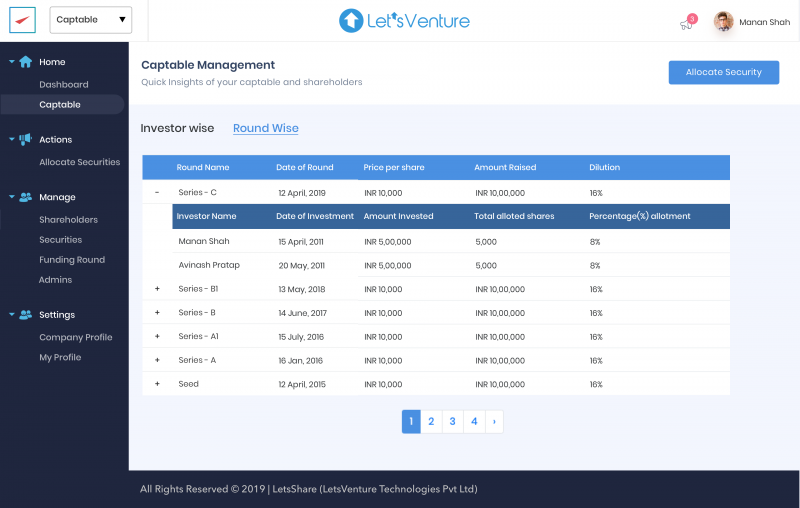

Typically, it is a point-in-time statement and supports the equity information in the balance sheet. Good cap tables also have additional features which enhance their utility. A classic example of such a feature is the ability to view the investments made in each round of fund-raising.

What is the Necessity for a Cap Table?

Cap tables are essential for startups. Being new organizations, they might not have the backing of a solid reputation, investors and lenders who trust the business, and good financial support. Cap tables are tools that establish transparency, build trust, show meticulousness and organizational abilities, and the professionalism of the founders. This will aid in building brand value, securing more funding when required, and enjoy a solid reputation.

To achieve this, a good cap table has to explicitly display the following details or possess the following qualities that investors or shareholders expect to see.

What are the Aspects that Investors Look for in a Cap Table?

When looking at a cap table, investors focus on two broad aspects – details and features. There are four crucial details and three features that enhance the value of a cap table in the eyes of an investor. These are discussed below.

Four Key Details to Remember

1. Share details

For every round of funding, a cap table must record and update the following:

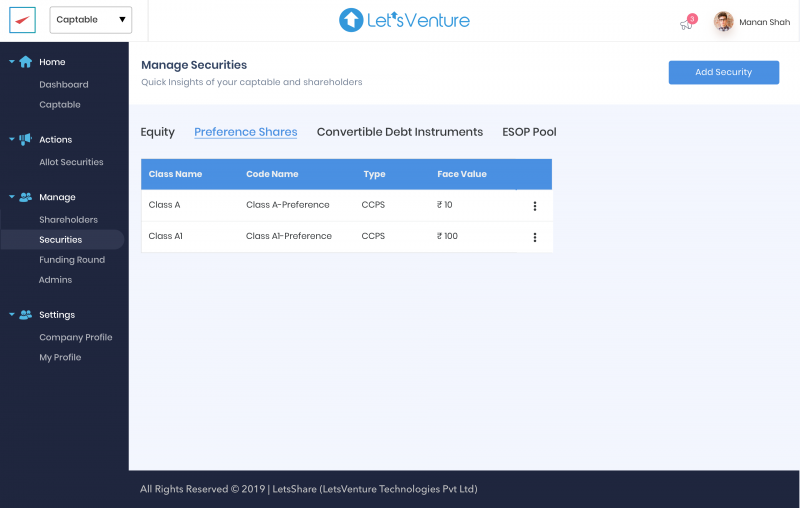

- Type of share (equity or preference)

- Class of share-based on the voting rights (class A or B)

- Number of shares authorized, issued, subscribed, and reserved for future options

- Details of convertible securities

- Stock options and their details like grant, vesting, exercise and sale.

Click here to read more about these terms pertaining to stock options.

2. Investor Details

Investor details refer to the name, contact details, identity validation, nominee(s) to the account held by the investor and other data that can help in identifying and verifying the authenticity of each investor. Each investor has access to their own details, which is proof of their holdings. Founders have access to the details of all the investors, which facilitates the operations and decision-making for future fundraising rounds.

3. Investment Details

A cap table should contain the instrument-wise amount of investment by each investor in every round of fundraising. In other words, investors must be able to see the components of their investment and the total amount. If this amount can be compared to the current market value wherever applicable, and the difference is shown in the cap table, they would also be able to view the returns on their investment. This will help in building trust in the company, which is beneficial for the founders.

4. Shareholding pattern

Investors and founders would like to know who holds what percentage of a company. This information is relevant especially at the time of fundraising. A cap table must capture this information since this detail is a crucial input for making key decisions that impact the company’s capital.

Three Essential Features of a Cap Table

1. Security

For an investor, the details of their holdings, along with the date and amount, are highly confidential. It is not something that investors would be comfortable sharing with the public. Such information is also personal for the company.

If it falls into the wrong hands, it can be misused. To protect privacy and ensure the safety of data, the cap table must be extremely secure. Multiple checkpoints must be in place, and red flags should be raised immediately, even if there is the slightest chance of a security breach.

2. Ease of Use

Any product that is not easy to use reduces its value to its users. Cap tables are no different. The data in a cap table must be well-organized. They must be well-connected, and a user must be able to navigate from one section to another with ease. A good cap table must also be easy to read and interpret. Using graphs, charts, and infographics to represent information visually makes it easy for investors to grasp it.

It must be visually appealing. Using simple yet elegant themes, legible fonts, uniform headings, pleasing colors, and a proper structure (chronological or otherwise) is strongly recommended.

Jarring colors, disorganized data, too many tabs, lack of structure in the presentation, and irrelevant information being strewn all over the primary pages of the cap table make it very difficult to read and grasp the essence of what the cap table should communicate. The information must be visually represented wherever possible.

3. Accessibility

However excellent it may be, a cap table doesn’t serve its purpose if it is not accessible to the users. Technology can be used to ensure this. A web portal and/or a mobile application where investors can log in and view their holdings and periodical emails with the latest updates can be useful. Companies must also ensure that cap tables are accessible from anywhere and at any time. This makes internal communication and decision-making simpler for the founders, and easily accessible for investors.

Given that, the founder or top management of a company may not have the time to prepare a comprehensive and professional cap table. Even if they do, they might not have the knowledge and experience of creating cap tables. It is highly recommended to get the cap table prepared by reputed professionals. They will also take care of maintaining and updating it.

Click here to view trica equity’s cap table offerings.

ESOP & CAP Table

Management simplified

Get started for free