What Is a Broken Cap Table? How Can It Be Fixed?

A cap table is a set of financial data which summarizes the financial condition of a company, including stock ownership and capitalization. In short, it’s a snapshot of the company’s financial status.

Cap tables are used to: (1) limit or control stock market activity that would be out of control with no limits on trading and (2) maintain fair value among shareholders. By providing a clear picture, a cap table prevents any shareholder from controlling more than a defined percentage of shares in any given company.

A broken cap table is often due to losses suffered in startups that have not made any profits or bad investments, incurring much debt. We will explore a broken cap table and how you can fix it.

Broken Cap Tables

A broken cap table occurs when there are no shares in circulation or too many shares for the company’s authorized stockholders. This could happen for various reasons – a merger, an acquisition, or a reverse takeover – and would require the board of directors to dilute existing shares or authorize the sale of existing shares.

The most common causes of a broken cap table are as follows:

1. The Company’s Equity Is overtly diluted

Excessively diluted corporate equity, low stock price, and too many outstanding shares lead to a broken cap table.

A new entrepreneur can make the error of giving up too much equity in their company too early, either to angel investors or during numerous initial funding rounds. This may take place voluntarily through priced equity rounds or inadvertently through a series of convertible loans, where the founders don’t realize how much equity is being indirectly handed away.

Later on, when the company requires additional capital, new external investors might be hesitant to provide it when they see how little equity – or, to put it another way, financial incentive – is left.

2. The Company’s Stock Price Is Not High Enough

A cap table can also be considered a company’s ownership structure, which will dictate who gets what share in case of an acquisition or a change of control event.

A company’s stock price measures how much people value the company. When a company doesn’t have a high enough stock price, it cannot be easy to raise capital. A broken cap table can also occur when investors’ shares are not proportional to their percentage of ownership in the company and can ultimately lead to dilution of earnings per share.

3. Inactive Shareholders

Too many inactive shareholders might break a company’s cap tables. Inactive shareholders are people who own shares in the company but haven’t bought, sold, or traded their shares in a certain period.

Here is how one can fix a broken cap table:

1. Deploy Founders-Only Shares

If you still have too much equity and potential investors are concerned, founders-only shares can help. These newly issued shares will decrease the ownership stakes of existing shareholders. Still, all stakeholders should recognize that new investment in the company would improve its prospects and everyone’s potential financial gain from an exit.

2. Dedicated Stocks for Founders or a Buyout

Most new enterprises are formed by first-time entrepreneurs with limited time and resources to acquire finance. To prevent losing control of their firm, founders should retain dedicated shares if they ever decide to go public or sell the business.

Since most new founders are not looking to build legacy businesses with their startups, they need to prepare for the eventual sale of their companies. This may be accomplished by forming a distinct set of shares (dedicated equities for founders) that enable the founders to retain ownership of their firm until they determine the optimal course of action during a buyout. To do this, founders need sound legal advice that can help them draft appropriate stockholder agreements and protect their shares from unauthorized transfer.

A partial or whole buyout may solve the problem of offering too much ownership to angel investors or advisers who no longer provide value. The buyout price must be negotiated, which might be challenging.

What is Cap Table Management?

A capitalization table (or “Cap Table”) refers to a document containing a list of authorized shares held by the firm’s founders, venture capitalists, angel investors, and any employees or consultants involved in the business plan.

Some of the factors that influence cap table include:

- Ownership structure of the business

- Stock dilution

- Option exercise windows

- Expiry dates at each round of funding for the company

Cap table management helps in determining the number of shares each shareholder owns at any given time.

While some businesses start with cap table management through Excel, others use a template as a foundation. However, cap table management is easier with software tools.

An efficient way for Cap Table Management

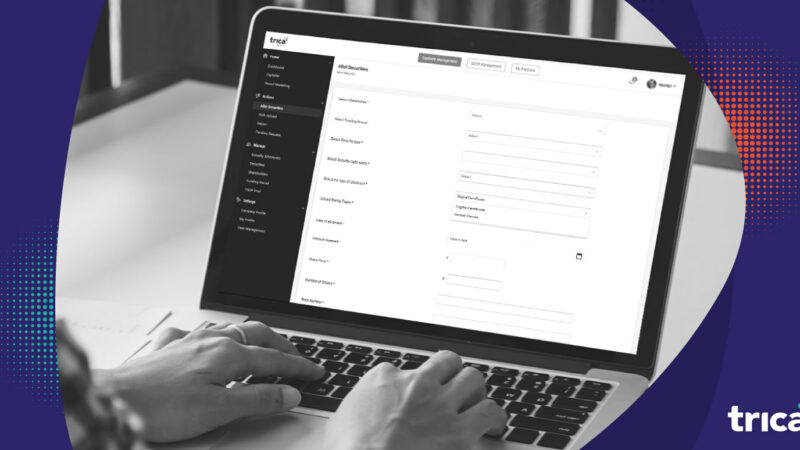

The most reliable method for guaranteeing an error-free cap table is to use dedicated cap table management software.

In its early phases, a company will have limited information to maintain in its cap table. However, the process of compiling data becomes more challenging as the firm expands. Therefore, you should switch to utilizing software for cap table management as it permits the administration of everything from a centralized location.

trica makes it simple to monitor and manage your company’s shares using cutting-edge technology. Take the first step in setting up a practical and easy-to-follow plan for managing your startup’s cap table and stock options. Contact us today for a free demonstration!

ESOP & CAP Table

Management simplified

Get started for free