Stock Option and ESPP: How Are These Employee Stock Benefit Plans Different?

Many companies offer stock options and employee stock purchase plans (ESPP) as benefits for their employees. Both these programs help employers capture the best talent for their teams while providing essential tools to build wealth for their employees. Besides, these employee benefit plans also improve employee engagement and ensure all employees are aligned with the company’s values.

Think about it. An employee with some degree of an ownership stake in the business is likely to be more aligned with the company’s vision and culture. These factors have a positive impact on recruitment, retention, efficiency, and the long-term success of the company.

Despite similarities in their names, both employee ownership benefits have different characteristics. A stock option is a qualified defined contribution retirement plan. It means that employees do not have to shell out money from their own pockets to purchase shares. On the other hand, employee stock purchase programs enable employees to use their money to purchase shares at a discount. This is the fundamental difference between a stock option and ESPP.

In this article, we will understand how these employee stock benefit plans differ from one another.

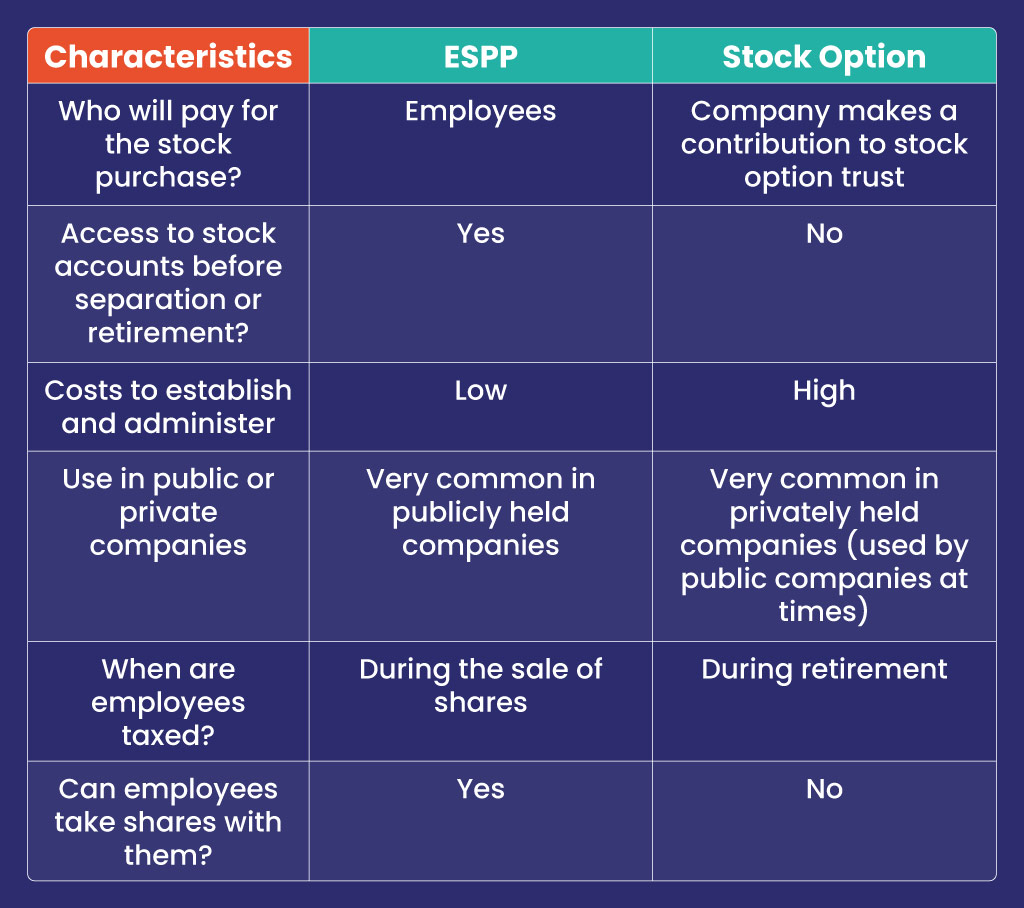

Stock Options vs. ESPP

1. Taxation and Ownership

In an employee stock purchase program, employees can buy company stocks at a discounted price with deductions in their payroll. Here, employees can define the percentage of their income that they would like to use to purchase stocks at a discount at regular intervals.

ESPPs can either be qualified or nonqualified plans. Under qualified ESPPs, employees do not have to pay tax on the discounted price when they purchase a stock. In this scenario, they are required to pay capital gains tax on profits when they decide to sell their shares. In nonqualified employee stock purchase programs, employees are liable to pay tax on the difference between employee stock price and the fair market value (FMV) during purchase.

Now, let’s talk about stock options. A stock option is known as a contribution plan that rewards employees by offering the value of stock ownership in the company over time. In simple terms, it means employees do not have to buy shares with their own money. Instead, the company issues stock ownership to its employees through a stock option trust when certain conditions are met.

2. Employer costs

In comparison with an employee stock purchase program, stock options always cost more to start and administer. This is because according to section 409(h) of the Internal Revenue Code, privately held companies must buy option shares when an employee exits the organization at the fair market value. This is known as repurchase liability or stock option purchase obligation.

3. Stock balance access

Employees who take part in stock option programs cannot access their balances until they part ways with the company. On the other hand, employees who participate in employee stock purchase programs can access their balances when their vesting cycle permits them.

Stock Options vs. ESPP: Synopsis

Benefits of Stock Options

Settling for a stock option plan is largely beneficial for all the parties involved, including the company and the employees.

Stock Options Benefits for Companies

- Employee retention

- Continuity in company legacy

- Efficiency and employee productivity levels increase as everyone is working toward helping the company grow

Stock Options Benefits for Employees

- Employees become partial owners of the company over a certain time period without any additional expense

- Retirement benefits in this scheme are much better than in traditional retirement plans

- Companies are liable to pay employees for their stock options when they decide to depart from the firm

Benefits of ESPP

Similar to stock options, there are a few benefits of opting for ESPPs for both, the company and its employees.

ESPP Benefits for Companies

- As a part of the participating employee’s payroll is deducted regularly, the company has a steady avenue for cash flow

- Compared to other types of equity compensation, the valuation of ESPPs is lower on a per-share basis

ESPP Benefits for Employees

- With periodic automatic share purchases, ESPPs enable employees to save more and become wealthy

- Employees can purchase company shares at a discounted price

Final Thoughts

The decision to start an employee stock purchase program or stock options primarily depends on the company’s philosophy and values. Before you decide, you should consider how the distinction between these stock benefit plans will impact your employee’s finances and the firm’s bottom line.

If you are an early-stage founder and unable to decide which stock benefit plan is better, get in touch with trica today. Schedule a free demo and let our team of experts guide you.

ESOP & CAP Table

Management simplified

Get started for free