This Is Exactly What Startup Founders Need to Know About Vesting Stocks

The share ownership of a startup is critical for both; founders and investors. In most cases, startup owners look to have their shares vest over a specific period. When stock ownership of important employees and founders is not tied to a vesting schedule, it could create a few problems for the startup. Therefore, they must understand what share vesting is and how it works. This article sheds light on share vesting and how it works.

Vesting Stock Overview

As more and more startups in the U.S. continue to offer stock options to attract top talent, vesting stock becomes very critical. Likewise, before startups issue equity and partial ownership of the company, stock vesting becomes important. But what do we mean by the term vesting stock? Let’s dive deep into understanding the concept of vesting stock and how it works.

What is vesting?

In layman’s terms, vesting is the process in which founders and employees earn shares periodically. This means that instead of getting equity in a company, employees and founders can earn a percentage of shares quarterly or on a monthly basis.

Vesting also gives employees the right to purchase their shares over a period of time. If a startup does not allow early exercising, employees can exercise only those stock options that have vested.

What is a vesting schedule?

A vesting schedule provides a basic timeline of when employees can earn options. Typically, the vesting schedule is explained in the employee’s option grant.

The three most common types of vesting schedules are:

- Milestone-based

- Time-based

- Hybrid (mix of milestone and time-based)

Time-based vesting

As the name suggests, time-based stock vesting enables employees to earn options in a stipulated amount of time. It is important to understand that most time-based vesting schedules include a vesting cliff. Now, what exactly is a vesting cliff?

Typically, cliff vesting is a scenario wherein the first segment of your option issues vests on specific data. The remaining options vest monthly or quarterly after that.

Typically, many startups offer option grants with a one-year cliff period. It is a common technique to motivate employees to stay at least for a year. If an employee leaves the firm within a year, all unvested options go back into the employee option pool.

Milestone-based vesting

Again, the term is self-explanatory. In milestone vesting, you earn options after the startup crosses a specific milestone. Apart from an IPO, other milestones for a startup could include completing a business goal, surpassing a particular valuation, project completion, and more. It is safe to say that milestone-based vesting is not as common as time-vesting.

Hybrid vesting

As mentioned earlier, hybrid vesting is a blend of time-based and milestone vesting. In the hybrid vesting model, employees need to work in the company for a specific period and also cross at least a single milestone to receive options.

Example of vesting schedule

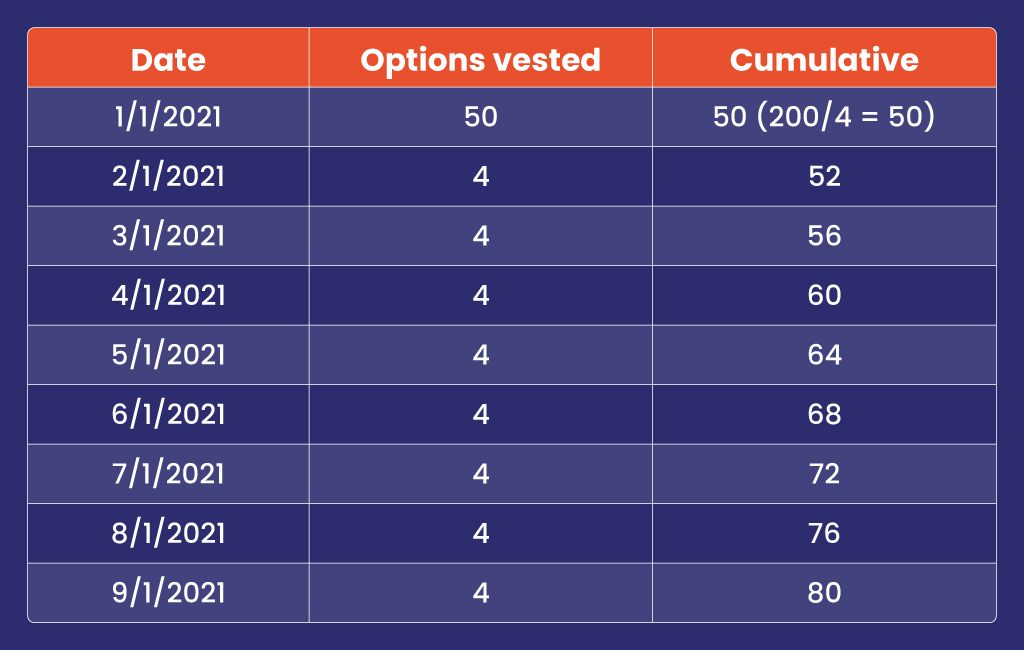

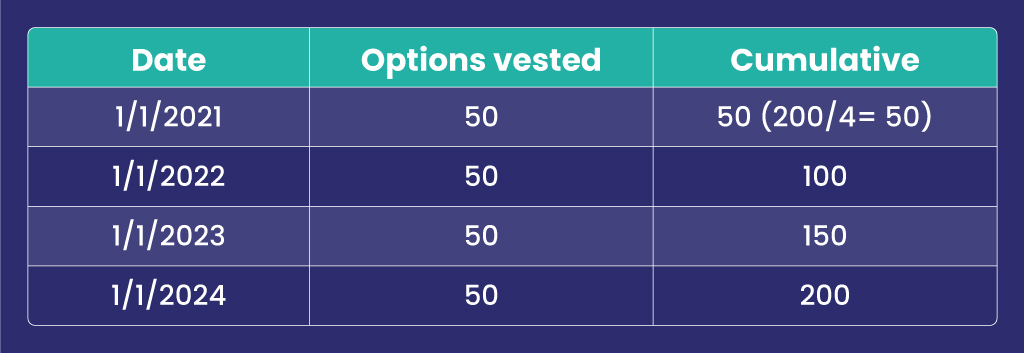

Shawn, Inc hired Jim on January 1, 2022. His compensation package includes an option grant with the following information:

- Grant date: 1/1/2021

- Options granted: 200

- Vesting schedule: Time-based; monthly for four years with a one-year cliff

After working for one year with the company, Jim reached the vesting cliff and ¼ of the shares (50) vested. After one year, i.e., on 1/1/2022, Jim had the option to exercise his 50 shares.

Over the next three years, four shares vest each month. On January 1, 2024, Jim’s options will be vested completely. After that, he can exercise all 200 shares in the option grant if he wishes to.

If Jim quits before January 1, 2024, he would have to surrender every unvested share. The unvested shares are added back to the company’s option pool.

Why do startups need vesting?

By now, we hope you have understood the basics of vesting stock and how it works. Now, let’s try to understand why founders need vesting. There are three reasons that make stock vesting important. One, stock vesting incentivizes employees and co-founders so that they continue to work in the company until their shares vest. Two, it protects the startup if a key employee or a stakeholder departs. Last, when startups vest their stocks, it highlights the founder’s commitment to growing the business to investors.

Another reason vesting is essential for founders is how they treat new hires while offering them partial compensation.

Final thoughts

Although vesting can be tricky and complicated, it is a good idea to chalk out a plan for employees, management, and company founders to whom equity is given. If you want to lay a solid foundation for your business to grow, stock vesting becomes important, especially for key employees and founders. Besides, a thorough and well-planned vesting schedule instills trust in your investors. Wondering how to create a vesting schedule?

trica equity can help founders navigate their way and create an organized vesting schedule. So what are you waiting for? March toward creating a successful startup with trica equity’s financial services. Get in touch to know more.

ESOP & CAP Table

Management simplified

Get started for free