How Transparency in Cap Tables Can Benefit Your Startup

Founders establish a business because they have a product or service they want to market. But as the firm grows and matures, the way they run their business must change to make strategic growth decisions.

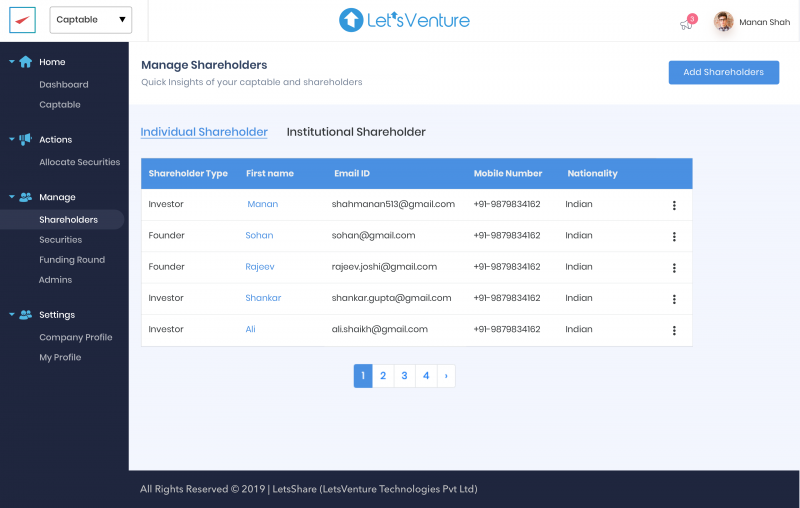

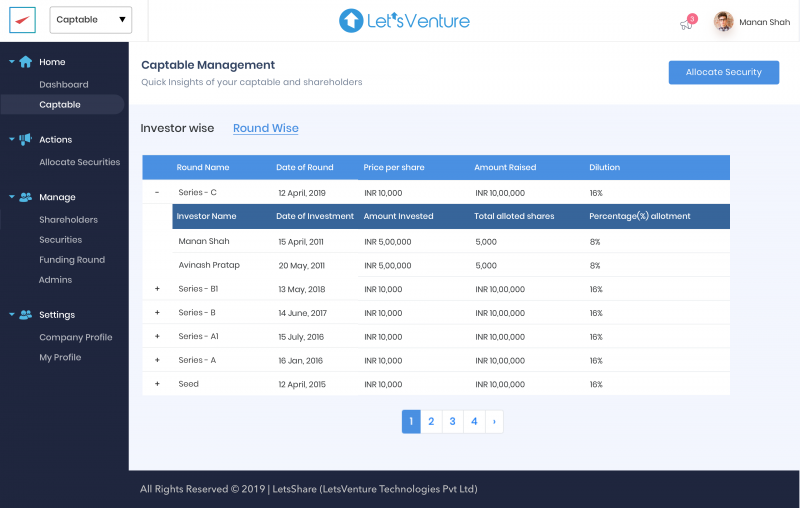

One such required corporate progression is creating and properly managing a capitalisation table (cap table). Capitalisation refers to the total and itemised value of all those who own equity in the company or have the right to receive equity in the future. It is an ideal proposition for the founders, especially of startups, to attract, groom, and retain quality talent in the organization.

Read more on managing cap tables efficiently.

So, what exactly is a cap table for startups, and why is it important for a company to have a transparent one?

Why are Cap Tables Important for a Startup?

To understand the need for transparency in cap tables, you must first understand why cap tables are important for a startup. For any equity-related decision, cap tables are the go-to document. It is the sole document with all of the information about a startup’s stock holdings in one location. The following are the most crucial reasons for a startup to have a cap table:

- Cap tables aid in the estimation of market value. The cap table is consulted for all shareholder reporting and new capital issuance.

- Existing shareholders have a good notion of how much dilution new investors can take.

- Potential investors can calculate their current shareholdings and their power if they decide to join the company.

- A historical look at cap tables can give you a sense of the company’s health and give you a leg up on the competition when it comes to wooing investors.

- A well-organized cap table allows the startup’s audit and legal teams to determine the company’s value by reporting best practices.

Now, let’s look into the growing demand for increased transparency in cap table data and its benefits.

How Cap Table Transparency Could Help Your Startup

Aiming for cap table transparency has many benefits for all parties involved.

For Investors

For the investor, more transparency equals more accurate information. More precise information equates to more assurance, and greater certainty equates to lower risk.

Investors feel a higher level of certainty with cap table transparency because they have all the information they need to perform their own internal assumptions and calculations. This is a crucial aspect of developing their high-level capital allocation plan since it allows them to estimate future investments better.

Companies with cap table transparency are a more fundamentally valuable partner from an investor’s standpoint, which puts them in a stronger position to attract further capital in the long run (and smarter money, at that).

As additional investors join your organisation, this becomes increasingly critical. This is due to the fact that your investors converse with one another even when the founder is not present.

Investors are universally interested in reducing risks and responsibilities to the greatest extent possible. Often, this entails following a predetermined trend, leaping into a hot industry, or simply speaking directly with one another.

The venture capital market now isn’t a zero-sum game. As a result, it’s not uncommon for a group of investors to work together by discussing portfolio businesses, distribution methods, and deal flows. Unfortunately, you and your team will seldom have a complete, 360-degree perspective of the numerous relationships and histories at play between them.

That’s why you should do everything you can to ensure that your company’s messaging is clear and consistent, even if you aren’t in the room to lead the conversation.

For Employees

Private corporations, unlike public companies, are not compelled by law to disclose equity and value data to their employees in a comprehensive and systematic manner. In truth, the key information needed to estimate a company’s value is tightly guarded by most private corporations.

Employees with ESOPs do not have access to the company’s cap table. Only when they exercise their options and purchase shares in the corporation do they have access to the cap table, where they, like any other shareholder, are entitled to information rights associated with their class of shares.

Your cap table, thankfully, tells the same story to everyone.

Sharing cap table facts with your investors is one of the simplest methods to maintain uniform messaging among your investors. And the advantages are numerous. The communication becomes clearer and faster. Smaller investors will appreciate the fact that they will have to do less due diligence upfront, and larger investors will appreciate the fact that deals will conclude faster.

To Sum Up

Whether you’re a founder, investor, or CFO, there are numerous benefits to sharing uniform cap table information with all your shareholders, including lower risk, enhanced communication speed and consistency, the prevention of internal conflicts during funding events, and (most significantly) improved overall transparency and confidence.

Communication is essential to long-term success in any partnership, which is why we recommend that you share cap table access with your investors and employees without any hesitation.

It’s simple and hassle-free to manage the equity of all shareholders. When looking at startups, equity is by far the most valuable resource. trica equity will digitise, secure, and manage your cap table and ESPs for free.

trica equity is a complete equity stack management platform for setting up your cap table, creating and implementing employee stock option plans, and serving as a vehicle for issuing employee stock options for your team. Our cap table management solutions are currently available in India, the United States, and Singapore.

Learn more about trica equity’s Cap Table Management solution. Request a demo.

ESOP & CAP Table

Management simplified

Get started for free