How Does Phantom Stock Work at Startups? Find Out Here.

If you are a startup founder, you know that top talent expects top compensation. Business leaders have recognized the need to incentivize and compensate loyal employees to keep them motivated and retain them. Many companies do so by issuing phantom stocks to their most valued employees.

Many private companies provide benefits to senior-level employees besides their salaries. Typically, these benefits are compensation such as company stock. Currently, there are many equity compensation plans including stock options, ESOPs, and phantom stock. When we talk about offering benefits for senior-level employees, phantom stocks are a great option.

Phantom stocks are commonly used across private businesses as they are more concerned with reducing the total number of shareholders. This is because minority shareholders could complicate transactions when businesses want to sell their shares.

In this blog, we will understand what phantom stocks are, and why companies use them. In addition, we will also look at the pros and cons of phantom stock plans.

What Is A Phantom Stock?

Phantom stock is an employee benefit wherein a few selected employees are eligible to receive benefits of stock ownership without actually purchasing company shares. Similar to real stock, the value of a phantom stock will increase or decrease based on the company’s value. Profits earned from phantom stocks are given to employees after a predetermined time period. They are also known as simulated stock, shadow stock, and phantom shares. Many companies offer them to employees who have gone above and beyond to serve the company.

There are different phantom stocks one can choose from depending on the organisation’s preference. This preference predominantly depends on the vesting schedule, which is a predefined timeline that states when employees can cash in on their stock options.

How Phantom Stocks Work in Favour of Star Employees?

As mentioned before, companies use phantom stocks to reward their hardworking employees. Typically, these employees have stayed in the company long enough and surpassed all expectations. So how does a phantom stock benefit the star employees of a company?

Let’s look at one example to understand this better. Let’s assume that a company wants to keep a top-performing senior manager. In their efforts to do so, they offer her a 12% phantom stock position bound by half-yearly profits. If the company makes a profit of $100,000, the employee will earn a $12,000 profit share bonus in that period.

Besides, the phantom stock also carries some additional incentives. If you decide to sell your company, it allows your loyal employees an opportunity to profit from the sale.

Benefits of Phantom Stocks for Companies

Now that we know how senior employees can benefit from phantom stocks, let’s understand how companies stand to benefit from them. From an administrative perspective, phantom stocks address several logistical challenges for employers.

The restrictions and requirements for phantom stocks are few compared to those for traditional stock option plans, which offer great flexibility in terms of how phantom stocks are structured. Please note that the management also carries the power to change phantom stocks to increase or decrease the vesting period, payouts, and other intricacies of phantom stock plans.

Besides, unlike traditional stocks, participants cannot sell phantom stocks to third parties. This is a huge relief for employers as they do not have to worry about any discrepancies with third parties during a merger, takeover, and other transactions. Lastly, when employees quit or the company terminates them, they can no longer avail the benefits of phantom stocks.

Different Types of Phantom Stock

Typically, two types of phantom stock plans are given as employee compensation. These include “appreciation only” and “full value” phantom stocks.

1. Appreciation Only Phantom Stock

Employees who are part of “appreciation only” phantom stock do not make any profit unless the stock price appreciates more than its value on the grant date. This stands true provided employees have fulfilled other conditions of the agreement.

2. Full Value Phantom Stock

Members who are part of the “full value” phantom stock deal get the current value and the appreciated value of the stock when they fulfill the phantom stock plan.

Phantom Stock: Advantages and Disadvantages

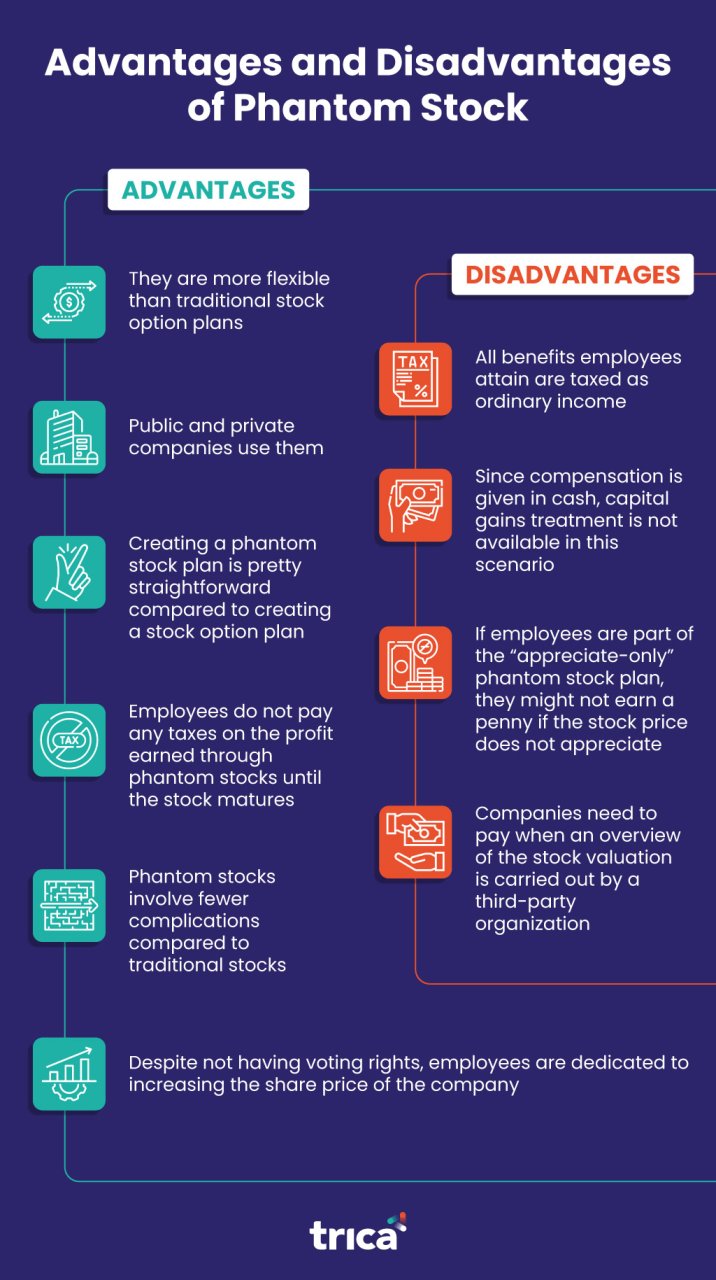

Now that we know how phantom stock plans work at privately owned businesses, let us weigh the pros and cons of offering phantom stocks from a company’s standpoint.

The Bottom Line

As seen in this article, phantom stock plans serve as a great way to reward and motivate long-service employees of your company.

The best part about this compensation plan is that when the value of a stock does not appreciate, both the company and employees have nothing to lose. This is one of the reasons why it is used by many privately owned businesses.

While there are significant advantages, do not get carried away. It is important to understand the cons of using a phantom stock plan, and it is essential to keep track of all shares of your company.

Get in touch with trica today. Our team of experts helps startups and established companies keep tabs on all phantom stocks in a company.

ESOP & CAP Table

Management simplified

Get started for free