This is the Ideal Number of Investors You Should Have on a Cap Table Management List

Founders wish to have control over the company and a deep incentive to continue working towards a big exit. They also want to have enough equity available to attract talented employees.

Investors often demand 20% of the business when investing. A founder risks having their ownership stake diluted by more than 20% by including multiple investors in an early-stage round.

Most startups require several rounds of funding before they can exit. Although dilution for the founders is unavoidable during the process, if each founder only receives a small portion of the company, they might not be motivated to continue working there.

What is Cap Table Management?

Cap tables give a detailed overview of each investor in the startup, along with the type of stake they have. It accounts for various security types, quantifies capital investments, and sets out the distribution of shares and ownership percentages.

Cap table management can be challenging since the ownership structure grows in complexity as the startup gains traction. Existing shareholders’ interests are diluted as new investors enter the market. All this information and resources like shareholder contact information and legal documents must be kept in exact detail on the cap table.

How a startup handles its cap table will influence how quickly the cap table management list expands. For instance, a startup may easily add more stockholders if it obtains funds from numerous small-scale angel investors or family and friends. In contrast, the cap table management list will be minimal if the startup has only accepted investment from significant investors who can cover the whole round of funding.

Similarly, if the startup has distributed shares directly to employees rather than creating stock options, this will speed the expansion of the cap table. The cap table management list may still be in place if the startup has established a stock option in its place and made it clear to the employees that they must wait to exercise their options until an exit event.

How to Decide and Control the Number of Investors on the Cap Table

The founder’s stake is paramount. At a basic level, investors want to ensure that their interests align with those of the founding team. The more potential value the team has, the more motivated they will be. Additionally, investors want to ensure enough equity is left over to attract additional investors in subsequent rounds. However, excessive founder dilution may indicate some potential risks.

A startup must avoid instances when a relative or an angel provides the funding it needs to start but imposes onerous conditions. Likewise, startups should avoid incubators or accelerators that demand excessive amounts of equity in exchange for office space or early guidance. These may reflect poorly on the CEO’s judgment. Some small angel investor groups can make investments through their investment vehicle as a single entity. An angel investor may occasionally be allowed to participate in the round by joining an existing investment entity.

The next key question focuses on how ownership is divided among the founding team. Investors generally prefer evenly distributed equity, and lopsided ownership such as an 80-20 split between co-founders, is likely to raise questions. There may be instances where founders might use the cap table to get “repaid” for expenses incurred during the cash-strapped phase of the company. In such a case, it is preferable to do an IOU instead of increasing the cap table management list by issuing equity to the founder. Repaying a founder with extra equity can give a pause to future investors.

A startup must communicate clearly with its option holders so that they might be able to postpone exercising their vested options. Options are exercised by employees when an exit event is anticipated or when the employee is leaving their job and needs to exercise the options before leaving.

Some of the investors may be willing to sell their stocks back to the company for a return on their investment. However, this will necessitate the approval of the other shareholders, and the startup will need to have the funds on hand to make it happen.

Implications of a Huge Cap Table Management List

It is normal for startups to expand their cap table management list way quicker than expected. However, when this happens, startups do not realize how painful having a “large cap table” is until it’s too late.

1. Beyond founders

The founder must pay attention to who else is sitting on the cap table management list. Instead of getting too many people, concentrate on getting the right people. For instance, if too many shareholders want a say in how the company needs to be run, it can get distracting. Instead of a list of 30 random people, a startup should have a lead investor, a strategic investor, and a great angel.

Most shareholder agreements stipulate that shareholders’ approval is required for different matters. Instead of holding a stockholders meeting, most startups will obtain approval via a “circulating resolution”. To do this, each stockholder must sign a document attesting to their vote. This can be a time-consuming process for startups with more than 30 investors, and this can be extremely annoying if prompt approval is required.

2. Dead equity share

Many investors also advise keeping an eye out for what refers to as “dead equity“—shareholders who do not provide anything of value but money. This covers shareholders who had some early involvement with the company but are no longer present.

It can be a third co-founder who left but still holds 20% of the business. It can also be a relative who gave money to the business’s initial funding during a family or friend round. However, too many investors who do not add value beyond money are a red flag to potential investors.

3. Investors’ attraction

Venture capitalists and substantial angel investors often choose “clear and simple” cap tables. This is because they know that the business can be more adaptable and won’t run the risk of being constrained by several small stockholders when it counts.

Closing Thoughts

A cap table management list gives investors a clear picture of the ownership of a firm, and an investor can see what proportion of the startup’s stock is held by the founders, investors, and employees. These numbers provide an essential clarification on who ultimately controls this startup.

Before raising the first round of funding, a startup must choose the number of investors it would want to have on its cap table management list in the long run. The startup must limit the number of small investors in the seed round to implement the minimum investment level in later rounds.

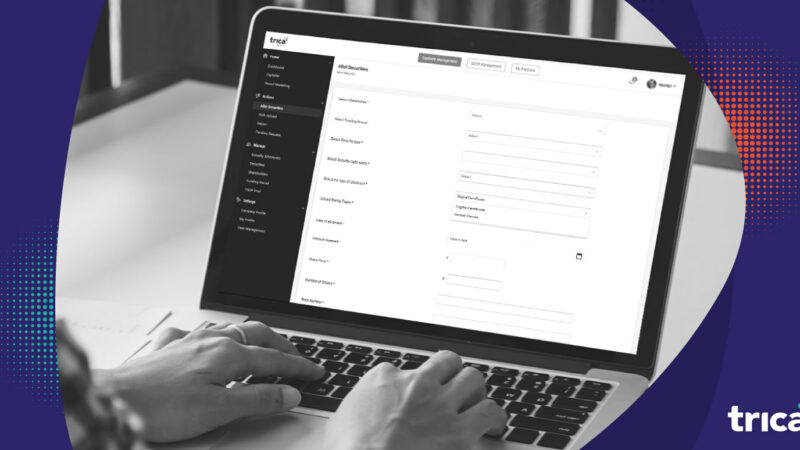

Startups can manage their Cap Tables on spreadsheets very early, but managing it can become a critical pain point as complexities increase. After a few years of growth and a few financing rounds, many investors enter the cap table management list. This is where trica equity comes in and simplifies its management.

To learn more about the limits on investors, contact trica equity now!

ESOP & CAP Table

Management simplified

Get started for free