What is a fully-diluted cap table?

A fully-diluted cap table is a version of the cap table that shows the total number of currently outstanding shares for each security and the totals from each convertible security if those were to be exercised. These convertible securities include stock options, convertible notes, compulsorily convertible debentures, and other shares waiting for an exercise event, such as ESOPs.

What purpose does a fully diluted cap table serve?

A non-diluted cap table does not highlight outstanding shares and the totals from unexercised securities. In actual exit events, these securities might get exercised or converted, leading to a drastic dilution. Investors, therefore, look into the fully-diluted cap table before making any investment decision.

Is this cap table accurate?

There might be instances when the exact number of shares cannot be determined as the exercise of underlying security might be based on certain conditions, such as a percentage of gross sales. In a case as such, the fully-diluted cap table will have footnotes highlighting the assumptions and specific conditions of exercise.

With respect to ESOPs, there are three possible angles to view ‘full-dilution.’ Footnotes are used to indicate if the ESOP formula is based on:

- The total number of options authorized by the ESOP plan – used most often

- The total number of options that are currently granted – makes sense if additional options are not likely to be granted for some time

- The total number of currently vested options is rarely used since options will continue to vest as long as employees stay employed. In certain cases, for example, when there is a long period before the next options vest, it might make sense to include an additional column in the cap table showing vested only options

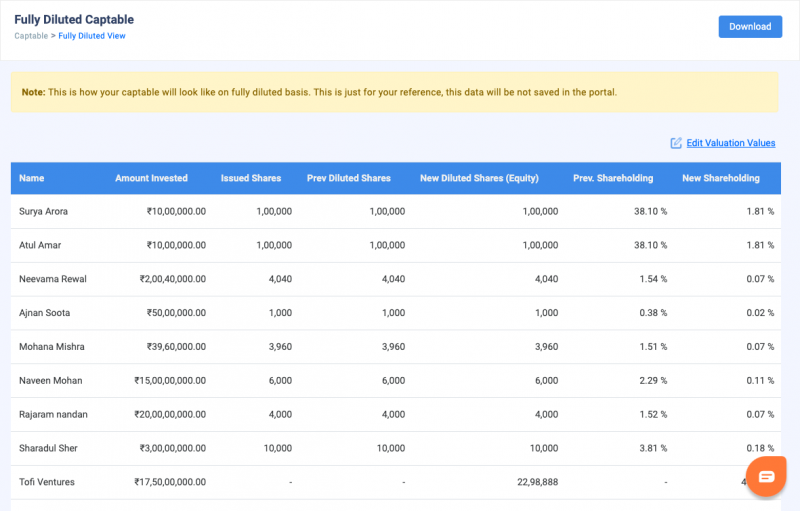

Fully-diluted cap table by trica equity

trica equity provides shareholders a fully diluted cap table view as a part of its cap table management tool. Watch the video to understand how it works:

Upon clicking this cap table view, users will be prompted by a dialogue box that asks the user to enter details and permission to convert convertible securities (with more than a 1:1 convertible ratio) to equity. Once the user grants permission to convert, the system automatically performs the required calculations and presents the fully-diluted cap table.

These calculations are complex, time-consuming, and error-prone when done manually. trica equity eliminates these constraints and provides investors and other shareholders with the fully-diluted cap table in a matter of seconds.

Schedule a demo now! It’s free

ESOP & CAP Table

Management simplified

Get started for free