Which Is the Right Equity Compensation for Your Tech Startup — Restricted Stocks or Stock Options?

In an increasingly digital world, technology startups are competing for the best talent fit for their organizations. Tech professionals are in demand, and no matter how high a compensation package you offer, there’s someone willing to top it.

Nevertheless, tech startups have an edge in the market — they function at the cusp of innovation and move quickly when taking products to market. By adding the right equity compensation to the mix, tech startups have a higher potential to attract and retain their dream teams.

In this blog post, we review the pros and cons of offering two of the most popular types of equity compensation — restricted stock awards and stock options.

Restricted Stock Awards (RSAs)

This is a type of equity compensation where the employee’s rights to the stock granted to them are restricted during a predetermined time frame. The contract comes with certain conditions which need to be met during the vesting period.

For instance, the employee may need to stay with the business during this timeframe, or the vesting conditions could also be performance-related. The employee may be required to achieve specific targets or goals, to be eligible for the grant. Additionally, the employee will be required to pay a purchase price to their company to exercise the grant.

Once the conditions of the vesting period are successfully met, the employee owns the stock in the company.

Tax Treatment of RSAs

Taxation of this type of equity compensation works in two ways:

- The employee is not taxed at the time of the grant. However, restricted stock awards will be taxed like normal income after the vesting period is complete and the employee owns the stock.

- The employee can choose to file an Internal Revenue Code Section 83(b) election and pay taxes on the restricted stock award. If filed within 30 days after the stock is transferred and they pay 100 % of the fair market value of the shares, then there’s no taxable income. If the stock is sold in the future, it is taxed as capital gains. The 83(b) election is beneficial, provided the value of the stock increases in the future.

Pros

The main benefit of RSAs is that it helps limit the amount of ordinary income tax paid by the employee. They can either pay for the underlying shares at the time of grant or file a Section 83(b) election.

Based on the contract, restricted stock awards can entitle the employee to receive dividends when distributed to shareholders. They are also typically exempt from deferred compensation tax rules as per the Internal Revenue Code Section 409A.

Due to the vesting rules, RSAs can incentivize employees to improve performance and stay with the company at least during the vesting period.

Cons

Employees will need to make a capital investment within a certain time frame for the stock to be issued. However, not every employee is in a position to do so. As the future of the company is unpredictable, chances are the price of the stock will not rise. These factors limit the chances of employees accepting this mode of equity compensation.

Secondly, if they forfeit the restricted stock after having filed for a Section 83(b) election, employees may not be able to get a refund on any tax paid.

Stock Options

Issuing stock options is another popular mode of delivering equity compensation. It offers employees the right to purchase a fixed number of shares of stock at a fixed price at the end of the predetermined vesting period. The value of the stock is based on the fair market value of a share at the time when it is granted. Vesting conditions for stock options are not performance-based. However, a timeframe is specified.

Tax Treatment of Stock Options

Stock options are typically classified into two categories for tax purposes:

- Non-statutory stock options (NSOs): They can be issued to employees, consultants and directors. When the stock options are exercised, they are taxed as ordinary income based on the recipient’s tax bracket.

- Incentive stock options (ISOs): ISOs are only issued to employees. Once the ISOs are sold by the employee, tax is applied to the capital gains.

Pros

From a beneficiary’s perspective, employees get to decide when to exercise the stock option. Thus, they are not bound by a specific financial commitment and also have control over the tax aspects.

From the company’s perspective, stock options work out as a superior incentive, as the recipient is only rewarded with the share price rises post the grant date.

Cons

When issuing a stock option, a company must offer it at an exercise price that cannot be less than 100 % of the fair market value of a share. Setting the right price is extremely important, or else it can invite tax penalties for the employer and the employee.

Ideally, the company must get a 409A valuation done by a third-party appraiser to come up with a fair market value. Additionally, ISOs, in particular, are governed by more complex employment, tax and securities laws. Moreover, this equity compensation does not include dividends.

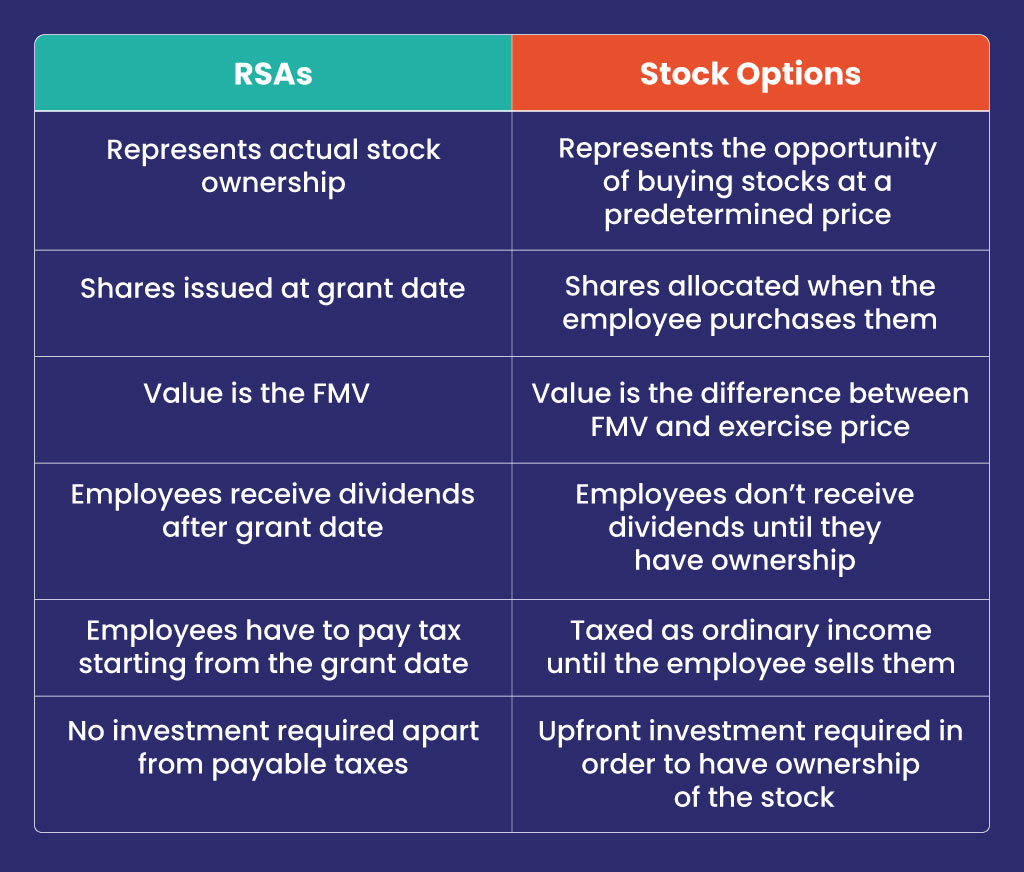

Restricted Stock Awards vs. Stock Options at a Glance

Takeaway

Offering equity compensation is an effective incentive to reward employees, consultants and senior management who add value to the business. However, choosing the right category is a strategic decision that should work in the best interests of the recipient and the company. It would be prudent for technology startups to seek professional advice before issuing a grant, as it has long-term consequences for all stakeholders.

trica equity is a brilliant equity management tool leveraged by several founders who wish to build a strong team. It is an end-to-end solution for businesses with excellent ROI.

Book a demo today to know more!

ESOP & CAP Table

Management simplified

Get started for free