The Impact of Alternative Minimum Tax on Startup Equity

Equity is the foundation on which a company’s core financials rest. The value of equity is indicative of the value of the firm. Startups need to pay extra attention to their equity since there are many key decisions, transactions, and events during the initial years of a company that has the potential to make or break the future of the company.

Alternative Minimum Tax impacts a startup’s equity, and therefore it is important to know what it is and study its impact.

AMT – An Introduction

As the name suggests, alternative Minimum Tax, a.k.a AMT is the minimum amount that a taxpayer has to pay. The first version of AMT was introduced in 1969 to correct the taxation system in which individuals with a specific income level that was high for those times did not have to pay any tax or the rate was extremely low.

This tax was to bring about fairness in the tax regulations so that those who earned high incomes paid at least a minimum amount of tax and did not get away from it by way of deductions or exemptions.

Since then, this objective has remained the same, but there have been several changes in the rules about AMT, which have subjected even assessees who are not in the category of high-income tax avoiders to incur a tax liability. This has put a strain on both individuals and corporations.

This article explores the impact of Individual AMT and Corporate AMT on a startup’s equity.

Individual AMT

AMT is designed to ensure that individuals pay at least a certain amount of tax. If an individual’s income exceeds a specified amount, AMT is calculated and compared with the regular tax liability. The higher of the two needs to be paid by the individual. The specified amount gets revised annually.

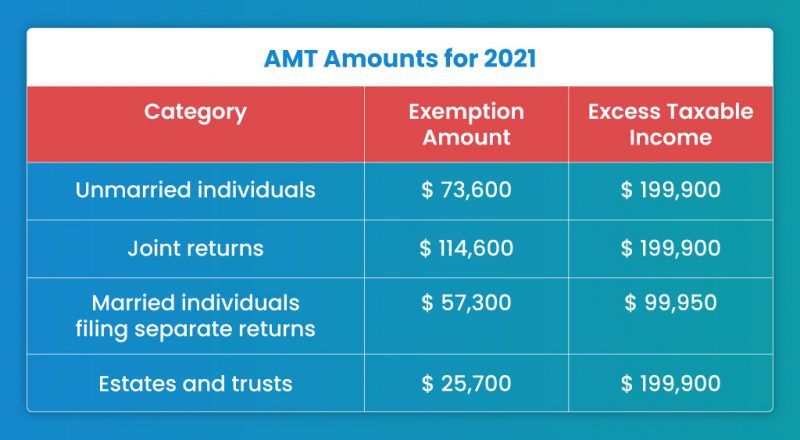

The following table shows the amount exempt from AMT and the excess taxable income for different categories of tax filers. These amounts are applicable only for 2021 and are revised annually by the Internal Revenue Service. The rate of tax on the excess taxable income is 28%. However, if the amount falls below the prescribed threshold (in column 2), the rate is 26%.

AMT and Startups – The Connection

Employee Stock Option Plans (ESOPs) or Stock Options are a preferred option for startups because companies may not have adequate resources in their initial stages to sufficiently compensate key employees who drive the success of the startup. Sharing a portion of the company’s equity is a way of compensating them in a cashless manner.

This also motivates employees towards improving the business performance so that the value of the equity for thetrica equitylves and their employer can be maximized.

AMT is invoked in one particular context: ESOPs. Employees who receive either from their employers are subjected to AMT when they exercise their right to buy the company’s stock at a discounted rate. AMT is charged on the difference between the exercise price and the Fair Market Value multiplied by the number of options exercised. Not sure what these ESOP terms mean? Click here to find out.

The Impact on Equity

The presence of AMT might discourage employees who are eligible for ESOPs from exercising their options. If this happens, the equity ownership of a startup may not get diluted. This may or may not be favorable for the company, depending on the motives of the founder and the initial investors. Even if eligible employees wish to exercise their options, the exercise price might be increased or inflated to decrease the AMT liability. This affects the issue price of the shares allotted to employees.

Employees who believe in their company’s potential to grow and perform well in the future would like to exercise their options to buy stock. If they do not do so due to the AMT, it might seem as if employees do not see a bright future for its stock, which might adversely impact its market value.

A Slight Relief

AMT has a silver lining, which is AMT credit. If an individual is subject to AMT in one particular assessment year, a certain amount called AMT credit is granted to them, which can be set off against the subsequent year’s AMT liability.

This way there is some relief since AMT credit is akin to a tax refund. The maximum amount of credit is equal to the difference between the regular tax liability and the AMT calculation in a particular year. The year of generation and claim of the credit cannot be the same. An individual has to plan the exercise and sale of shares acquired via an ESOP, considering the AMT, in order to ensure that the decision is financially sound.

Corporate AMT

Nearly three years ago, there was a significant change in the applicability of AMT. Till 31st December 2017, AMT was applicable to both individual and corporate taxpayers. The Tax Cuts and Jobs Act (TCJA) removed AMT for corporations from 1st January 2018 onwards.

The Nuances

Before such removal, the tax liability for a corporate used to be the sum of the regular tax amount and the AMT amount. The calculation of AMT for a corporate used to be tentatively 20% of an adjusted taxable income known as the Alternative Minimum Tax Income or AMTI, subject to a standard deduction. This was computed by making adjustments and exemptions to the regular taxable income.

Small Corporations, defined as those companies whose gross annual receipts for the preceding three years did not exceed $5 million for startups and $7.5 million otherwise, were exempt from AMT.

Overall, computing and managing AMT was an extremely cumbersome process, not to mention that it added to a company’s tax liability. Repealing this was a move in favor of corporations.

Another benefit is that AMT credit for corporates that are carried forward from previous years can be used to minimize the tax liability, and any leftover is fully refundable in 2021.

The Impact on Equity

The removal of AMT for companies and retention of corporate AMT credit reduced the pressure on companies’ income statements. For startups, this is a much-needed sigh of relief since ensuring their profitability in the first few years is a Herculean task, which is often not reasonable to expect.

A startup’s equity is greatly impacted by its profitability. Easing the load on this factor by repealing Corporate AMT has positively impacted startup equity. Although an exemption was provided to small corporations/startups, the deduction provided to a loss-making company did not shield it from AMT by a significant amount, since the AMTI did not change by more than 10% even in such cases.

To sum up, the Alternative Minimum Tax is a system by itself. Startups, in particular, need to pay attention to the nuances, since AMT can affect its equity.

trica equity offers valuation services at startup friendly prices. Check it out

ESOP & CAP Table

Management simplified

Get started for free