ESOP Accounting & Bookkeeping

There is a pandora of misconceptions around ESOP accounting treatment, the requirement of valuation reports and disclosure, etc., across the startup ecosystem.

For companies following AS for their accounting, ICAI has issued an 80 pager guidance note that governs the accounting treatment for ESOPs. This is called ‘Guidance Note on Accounting for Employee Share-based Payments.

The Detailed Classification of Guidance Note

ESOP accounting based on the Guidance Note can be broadly classified into two categories, and it is the choice of the company to choose any of them:

- Intrinsic Value Approach

- Fair Value Approach

Which method is more appropriate? Intrinsic or fair?

The intrinsic value approach and the fair value method are the two methods for ESOP valuation.

#1. Intrinsic Value Approach

The difference between the market price of the ESOP share and the exercise price of the option is known as “intrinsic value.” Example: A company offers its employees an ESOP with a current market price (CMP) of INR 150 that can be exercised for INR 110 after two years. The intrinsic value, in this case, is INR 40.

However, if CMP is INR 90 instead, the option has no inherent value because the exercise price is greater than CMP, thus options cannot be exercised and must instead be lapsed.

Let’s start with the Intrinsic Value Approach: We have structured our discussion in an industry-accepted chronology and explained the same with an example. The below example will explain an ESOP journey of a company from the beginning. Italics lines in between are the provision and the guiding principle, which one needs to follow and take care of.

Here we go!

Founders of ABC limited were planning to introduce ESOPs in the compensation structure. With the help of trica equity.com and their channel partners, ABC Limited could draft an ESOP scheme that was best suited to them.

They got it approved by their board (via board resolution) and shareholders (via special resolution) on 21st March 2019. On 1st April 2019, Mr. X, the Chief Brand Officer, was granted 5000 ESOPs, and each option was convertible into one equity share post completion of the vesting period of 4 years. Each year 25% of his options, i.e., 1250, will vest.

Now, to start with the ESOP accounting entries, we primarily need three inputs:

- Exercise price: ICAI has provided no specific rule to determine the Exercise price. It is based on the best judgment of the company. ABC limited can fix the exercise price based on the discussion with their board.

- Intrinsic Value of the underlying share: Value of the shares determined by an Independent Valuer, be it a Chartered Accountant or a Merchant Banker as on the Grant Date. Please note that one needs to obtain an Intrinsic Valuation report on every grant date.

- Value of the option issued: FMV of the underlined share as on the (Grant date* – Exercise price)

*Based on the industry standards, a 6 monthly old valuation report can be considered to determine the FMV of the underlined shares subject to the following conditions:

- No new funding round has happened in the past 6 months

- No abnormal or unusual event has taken place which has significantly affected the business

Mystartuequity.com connected ABC Limited with its partner legal firm and valuers. With the help of the external consultants, ABC Limited arrived at the following numbers:

- Exercise price/ Strike Price was kept at INR 2500

- Intrinsic Value of the underlying share: INR 5500 (based on the share valuation report) and the face value (FV) of the share was INR 10

- Value of the option issued: INR (5500 – 2500) = INR 3000

As per the Companies Act 2013, there should be at least a year between the grant date and the vesting of an option. So, in this case, the first vesting can only be on 31st March 2020.

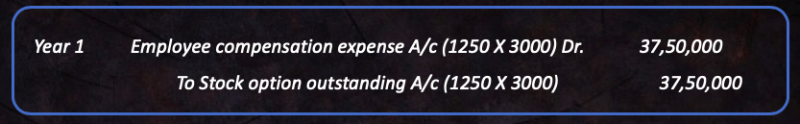

No accounting entries are required to be passed on the grant date. We need to have an option value in place, as discussed above. Accounting entries typically come into the picture on the completion of the first vesting. On 31st March 2020, Mr. X’s 1250 options will vest having an option value of INR 3000 per option. We will be passing the below entry to record this expense:

Employee compensation of INR 37,50,000 will sit on the debit side of P&L, and the Stock option outstanding will sit as a liability in the Balance sheet as a separate heading between Share Capital and Reserve and Surplus.

Assuming that Mr. X completed all the four vesting, the same accounting entry will be passed on the 31st March of Year 2, Year 3 and Year 4.

At the end of year 4, the total of the Employee compensation expenses booked in the P&L would be INR 150,00,000 (i.e. 5000 option vested of INR 3000 each), and also the Stock Options Outstanding A/c would show a total of INR 150,00,000 (i.e. 5000 option vested of INR 3000 each).

Based on the ESOP schemes, Mr. X has a right to exercise the ESOP or not to exercise the ESOP. Accounting for both the possibilities will be as follows:

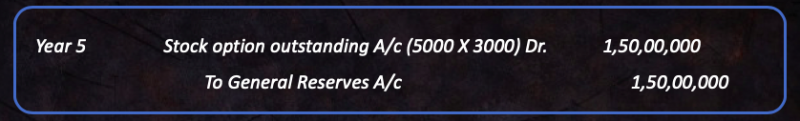

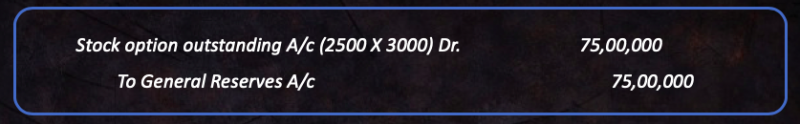

1. Mr. X does not exercise the ESOP within the exercise period: The amount lying in the “Stock Options Outstanding A/c,” i.e., INR 1,50,00,000 will be transferred to general reserves in the year in which the exercise period ends. In this case, to keep it easily understandable, we have assumed a 12 months exercise period. Therefore the reversal entry would be passed in Year 5.

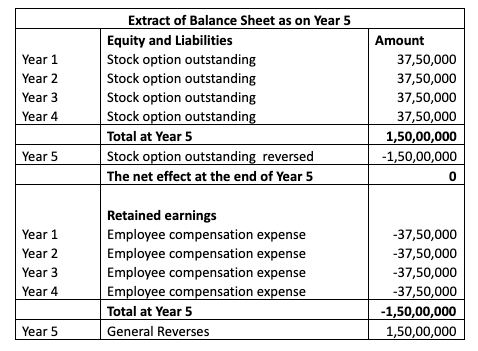

At the end of Year 5, the Balance sheet will look like this:

2. If Mr. X exercises the ESOP within the exercise period (i.e. 12 months): We can infer that ABC Limited is liable to issue 5000 shares @ INR 2500 per share (exercise price) to Mr. X if he exercises his right to convert the options into shares. Over the period of four years, ABC Limited has booked expenses of INR 150,00,000 and liability of INR 150,00,000.

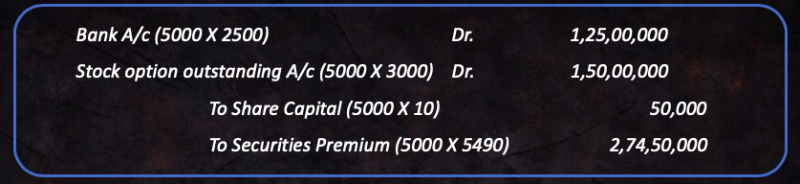

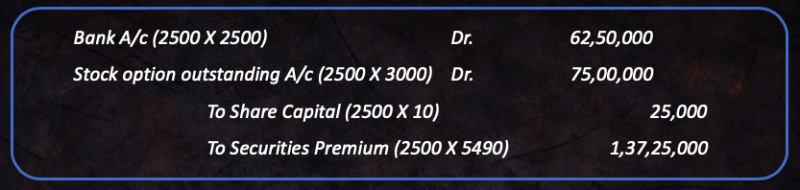

At the end of Year 5, all the options were exercised by Mr. X; therefore, Mr. X paid the exercise price, i.e. INR 1,25,00,000 (5000*2500) to ABC limited as 5000 shares are issued.

The following entry is passed for the exercise and share issue.

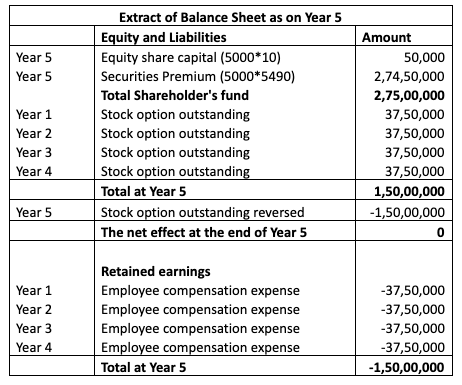

At the end of Year 5, the Balance sheet will look like this

Note:

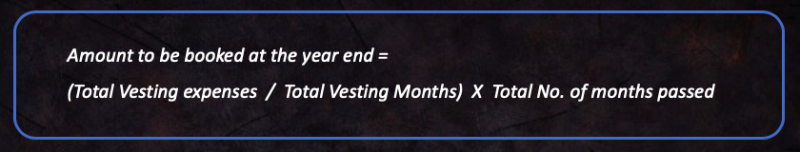

- If the grant date is in between the financial year, then one can book the proportionate expenses as of 31st March based on the number of months passed using the below formula:

- If Mr. X has left the organization (say after two years post completion of 50% of his vesting), then the following treatment can be done:

- If he has exercised 50% of his options:

-

- If he does not exercise the options: Expenses booked for two years will be reversed by passing the following entry.

#2 Fair Value Approach

Now comes the Fair value approach. All the entries that need to be passed are the same as are there in the Intrinsic Value Approach except the following:

- Option value will be based on the Option Valuation Report (OVR) obtained from an independent valuer, be it a Merchant Banker or a practicing Chartered Accountant, to determine the value of the option granted as the date of grant. The option value in this method cannot be calculated based on the formula mentioned in the Intrinsic Value approach. OVR is different from a regular share valuation report, and the option value is generally arrived at by using the Black-Scholes Model.

- On every grant date, ABC limited is liable to get an OVR. As per the market practice and OVR, not older than six months is considered valid. There is no change in the terms and conditions of the two grants, and no unusual event has happened in the company that can substantially hit the options valuation. Therefore, it is advisable to plan your granting of options in a 6 months period because, as per industry standards, the valuation report is valid for a maximum period of 6 months given.

The fair value of an ESOP is estimated using an option-pricing model such as the Binomial Model or the Black Scholes Merton.

Factors to be considered in option pricing model

- Exercise price – The price at which the option will be exercised—is one of the factors examined in the option pricing model.

- When calculating the expected life of stock options granted to a group of employees, the company could use an appropriately weighted average expected life for the entire group of employees or appropriately weighted average lives for subgroups of employees within the group, based on more detailed data on employee exercise behavior.

- Listed firms should take into account the historical volatility of their own stock, whilst unlisted companies should assume zero volatility. Unlisted companies can also evaluate the volatility of similar publicly traded companies as an option.

- Dividend yield – Companies are obligated to forecast their dividend yield rate in the future. The projected future dividend yield can be calculated using the past dividend yield.

- Risk-free interest rate for the duration of the option – The risk-free interest rate is the current implied yield on zero-coupon government securities or bonds.

Which method is more appropriate?

The fair value method is preferred since it considers different factors such as time value, interest rate, volatility, and so on. The Intrinsic Value Method does not take these things into account.

Disclosure requirements:

Further, ABC Limited also needs to do certain disclosures in the notes to accounts, and these disclosures are also prescribed by the ICAI in their Guidance note. The disclosures for the Intrinsic value approach and Fair value approach are generally the same except the below:

- Where an enterprise follows the intrinsic value approach, it should also disclose the impact on the net results and EPS – both basic and diluted – for the accounting period, had the fair value method been used.

Other than above all, the disclosures are similar for the intrinsic value and fair value approach. All the critical disclosures are listed below.

-

- Background of the ESO scheme is to be given in the manner given below: “Employees covered under the Stock Option Plan are granted an option to purchase shares of the company at the respective exercise prices, subject to the requirement of the vesting conditions. These options generally vest in tranches over a period of 4 years from the date of the grant. Upon vesting, the employee can acquire one equity share for every option.”The stock compensation cost is computed under the fair value/ intrinsic value method and amortized as per the vesting schedule over a period of 4 years. For the year ended 31st March,….. ABC Limited has recorded the stock compensation expenses of INR …….. (previous year ……..).”

-

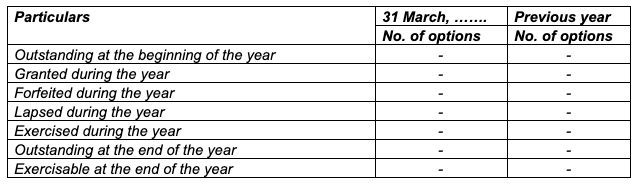

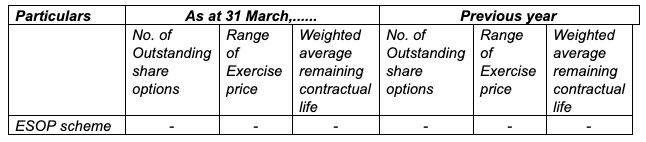

- Activity for the period needs to be summarized in the below manner:

- The exercise price, weighted average price, and weighted average contractual life are to be given for the option outstanding at the year-end.

- Activity for the period needs to be summarized in the below manner:

———–

Check out our blog on the tax implication of ESOPs on employees!

Disclaimer: This article has been prepared for general guidance on the subject matter and does not constitute professional advice. The matters described herein are general in nature and have not been evaluated based on applicable laws. You should not act upon the information contained in this note without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this note. LetsVenture Technologies Private Limited, its partners, employees, and agents accept no liability and disclaim all responsibility for the consequences of you or anyone else acting or refraining to act in reliance on the information contained in this publication or for any decision based on it. Without prior permission of LetsVenture Technologies Private Limited, this note may not be quoted in whole or in part or otherwise referred to any person or in any documents.

ESOP & CAP Table

Management simplified

Get started for free